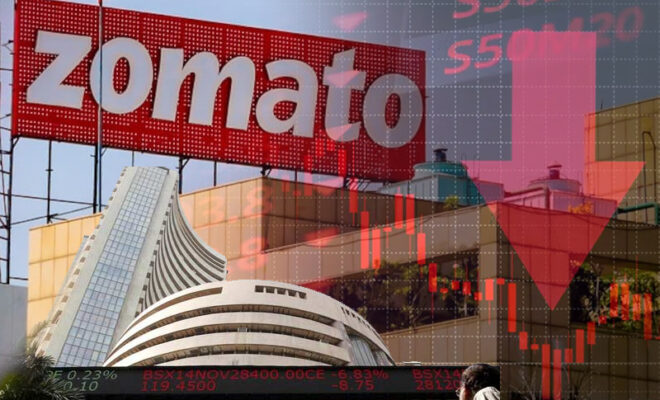

Zomato’s shares hit an all-time low of around Rs 50 on Monday, July 25, after the year-long lock-in period for its pre-IPO concluded on Friday (July 22). The company’s stock price dropped as low as Rs. 46 in the early trading hours, or about 40% below its issue price of Rs. 76.

The obligatory lock-in period for promoters, staff members, and other shareholders who purchased Zomato stock prior to its IPO concluded on Friday. The main cause of Monday’s significant sell-off, according to experts, is that these stockholders are now free to sell their shares.

In accordance with Securities and Exchange Board of India (SEBI) regulations, a company’s pre-IPO shares are locked in for a year if there are no identified promoters. “Depending on market conditions and their investment horizon, pre-offer shareholders may sell their shares in our firm after the one-year lock-in period. Additionally, any belief by investors that such sales would take place might have an impact on the market price of the equity shares, according to Zomato’s Red Herring Prospectus before its first public offering (IPO).

The firm was valued at roughly Rs 43,200 crore as a private company, but its market worth at the time this article was published was just Rs 37,911 crore. At its previous peak, the company’s stock was trading at Rs 169.10 a share, with a market capitalization of Rs 1.33 lakh crore. As of the time of publication, more than Rs 95,000 crore in investor wealth had been lost.

The last time the company’s shares suffered such a steep downturn was following its purchase of fast-commerce startup Blinkit (formerly Grofers) last month. Zomato’s shares had fallen by more than 20% during the next four sessions.

In July of last year, Zomato became the first significant startup to list on the stock exchanges. The company’s shares, which were offered for Rs. 116 a share, a premium of 53% over the IPO price of Rs. 76, saw a record-breaking opening. The stock’s value, nevertheless, has steadily decreased ever since it peaked in November of last year at Rs 169.10 a share.

Since going public, the stock values of other firms that followed Zomato to the exchanges have also seen a sharp decline. Paytm, which had an initial public offering price of Rs 2,150, was down more than 65% at the time of publication and trading at Rs 740.35.

As its shares were up 78% when it initially floated, e-commerce firm Nykaa, which had an issue price of Rs 1,125 per share, saw a brisk listing. The share’s price has now dropped, with the scrip selling at Rs 1,410.35 at the time of publication.