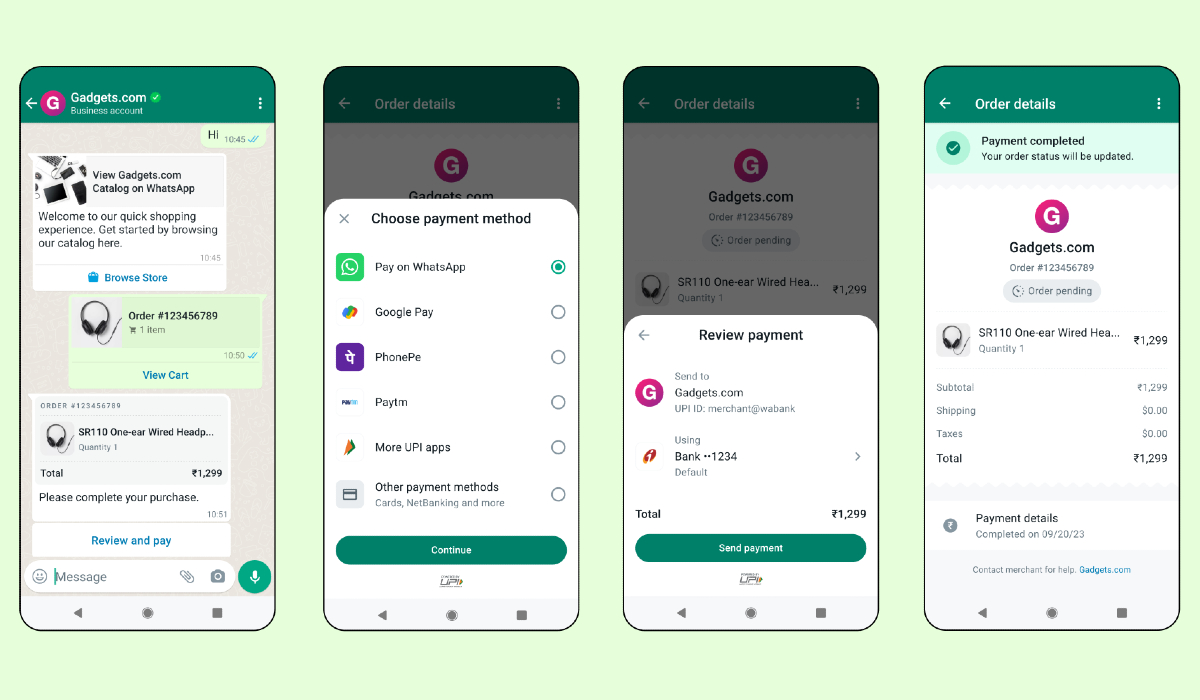

In its largest market, India, WhatsApp is introducing a new feature that will let users pay companies inside the instant messaging app using a range of payment methods.

The Meta-owned app announced on Wednesday that it has teamed up with PayU and Razorpay, which has its headquarters in Bengaluru, to enable support for payments made in India using credit and debit cards, net banking, and all UPI apps.

After collaborating with Stripe earlier this year to enable its users in Singapore to pay merchants using the app, WhatsApp decided on Wednesday. In June, the app allowed for merchant payments in Brazil.

Mark Zuckerberg, the founder and CEO of Meta, made his statements virtually at the company’s Conversations 2023 event in Mumbai. “This is going to make it even easier for people to pay Indian businesses within a WhatsApp chat using whatever method they prefer,” he stated.

TechCrunch received a confirmation from WhatsApp that all Indian firms using the WhatsApp Business platform can use the payment tool.

India alone has more than 500 million active WhatsApp users, becoming South Asia Meta’s biggest international market. The app launched its UPI-based payment services in India in 2020 as a test program, which was later expanded to 100 million users the previous year. The UPI ecosystem is dominated by companies like Google Pay, Walmart-owned PhonePe, and the Indian financial behemoth Paytm, so it still has a tough fight ahead of it.

Previously, UPI-based WhatsApp Pay enabled Indian businesses on WhatsApp to accept payments from clients. With the help of its JioMart bot, the Indian giant Reliance Industries last year provided a complete buying experience on WhatsApp. On the contrary, the most recent update elevates the user experience by enabling merchants on the app to accept payments from external origins.

Moreover, this enhancement expands the possibilities for WhatsApp to function as a commerce solution for both individuals and businesses. Nevertheless, despite boasting a global user base exceeding 200 million monthly active users, WhatsApp has yet to observe a substantial portion of its regular user base in India actively participating in purchases through its platform.

For WhatsApp, which does not directly charge users through subscriptions and has no plans to broadcast ads in chats, WhatsApp Business has been a vital source of income.

The app offered paid capabilities for automation and personalized merchant communications earlier this year. As more people shop over WhatsApp, attracting more businesses, improved payment functionality may increase income. A function dubbed Flows will let users carry out operations like selecting a seat on a flight or making an appointment right from the chat app, giving WhatsApp users a fuller in-app buying experience.

Ankit Kataria is an experienced content writer with over 2 years of expertise in crafting insightful articles on startups, trending topics, business, economy, and finance. With a keen eye for detail and a passion for delivering well-researched content, Ankit ensures that his articles are engaging, informative, and valuable to readers. His writing style blends analytical depth with clarity, making complex topics easily understandable for a broad audience.