Over the past few months, an infamous Solana MEV Sandwich Bot called “arsc” has emerged. This bot has been able to extract $30 million from users through MEV attacks, sparking debate in the Solana community. MEV arbitrage has attracted a lot of controversy within the crypto community. While some people see it as a standard trading practice, others regard it as unfair and detrimental to the ethical culture of decentralized systems.

The Rise of “arsc”

In a recent post, Ben Coverston, the founder of MRGN Research, pointed out the actions of the “arsc” bot. He pointed out that this bot has been careful not to bring attention to itself while earning high profits on the Solana network. The bot interacts through several major wallets, all performing various tasks in its complex management system.

MEV Sandwich Attacks

In the MEV sandwich attack, the attacker places their transactions before and after a victim’s transaction to capture MEV. The attacker first acquires the victim’s token at a cheaper price before the victim trades and then sells the token at a higher price within the same block. This type of attack is common in DeFi applications because these systems include transaction orders that can be manipulated.

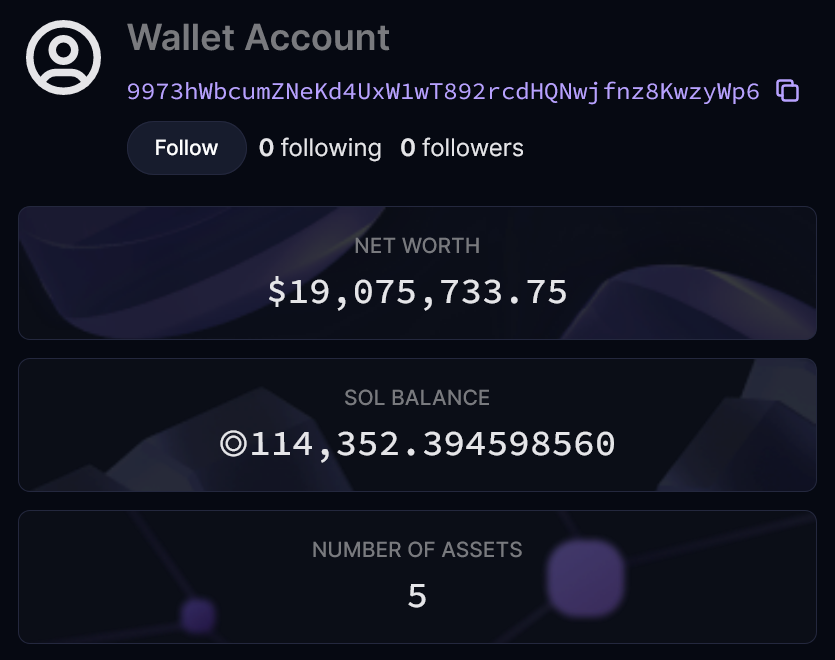

Cold Storage Wallet

The “9973h…zyWp6,” one of the leading wallets linked with the “arsc” bot, serves mainly as a cold wallet. This wallet contains more than $19 million, of which $17 million is in SOL tokens, and $1.1 million is in Circle’s USD Coin (USDC). Its behavior appears to be that of a highly secure wallet that is rarely accessed, similar to cold storage.

DeFi Wallet

Another sizable wallet, “Ai4zq…VXKKT,” is engaged in DeFi operations. This wallet has over $9.9 million, mainly in non-SOL tokens, and continues trading activities without interruption. It slowly swaps SOL for USDC and holds significant amounts of different liquidity staking tokens (LSTs) and decentralized applications, such as Kamino.

Main SOL Bank Wallet

The third wallet, “BCbrp…vi58q,” is considered the “main SOL bank” for the bot, as the bot uses many signers and tippers for sandwich attacks. This wallet has a complex structure, and increased activity indicates that this bot operates continuously and its activity is covered up.

Implications for both Solana and its users

The operation of the “arsc” bot has severe consequences for Solana and its users. Overall, MEV sandwiches can have negative consequences for users and shed light on weaknesses in the network. Even though such activities are not peculiar to Solana and have been witnessed on other blockchains such as Ethereum, the scale and complexity of the “arsc” bot are pretty remarkable.

Solana Network handles the issue

Like other blockchain networks, the Solana network is advancing in addressing issues such as MEV arbitrage. Although the search results do not contain specific actions implemented by Solana to address the MEV arbitrage problem, it is evident that the network recognizes bots such as “arsc” and their effect.

Various approaches can be used to address the impact of MEV arbitrage on blockchain networks: better transaction prioritization, increased openness, and ethical trading. Moreover, conversations about MEV within online communities and academic studies can improve the protocol and prevent users from exploitation.

Conclusion

The story of the “arsc” bot’s appearance on Solana is another episode in the security fight between blockchain projects and experienced hackers. Although it is fascinating that the bot has made $30 million in a relatively brief time, it also raises concerns regarding the necessity of improving things within decentralized finance and being much more cautious. Solving these issues will become necessary as the ecosystem advances to ensure that users’ confidence and the networks’ reliability remain intact.