Friday, 28 July 2023, Bengaluru, India

Snap’s Q2 23 performance report, which indicates a gain in overall users, particularly in developing areas, as well as signs of recovery for Snap’s ad business, which now has more ad partners than ever and is experiencing improved optimization performance, has been released.

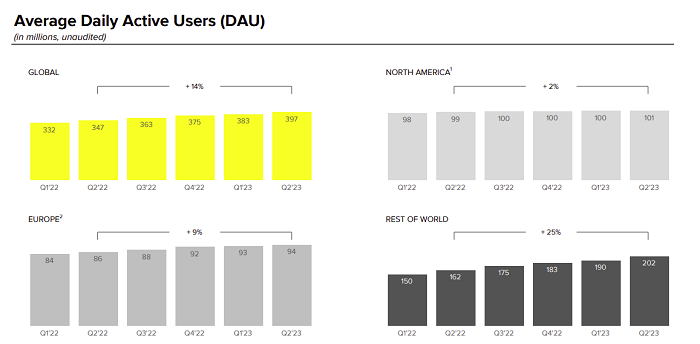

The majority of that growth is still coming from the ‘Rest of the World’ category, with Snap only adding a million more users in both North America and the EU respectively. Snap added 12 million more users outside of its main markets, with the app continuing to see solid take-up in India, where mobile adoption and improving connectivity have opened up new opportunities for the app to reach this audience

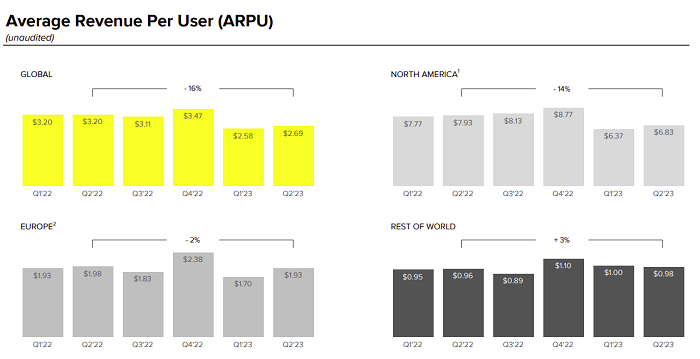

Indeed, over the past year, Snap has added 40 million more users in the ‘Rest of the World’ category, while adding 10 million in the US and EU. This bodes well for its future opportunities, though the immediate revenue benefits are not as significant.

Just over $1 billion was earned by Snap overall in Q2; this is a 4% year-over-year decline but an 8% quarter-to-quarter rise in revenue.

Although Snap is still recuperating from the effects of the altering digital ad industry and the general economic slump, it does remark that its ad solutions are now performing better, which will eventually result in greater uptake.

Therefore, more advertisers are using the app, which is encouraging for its future success, but it isn’t yet translating into significant financial gains for the company as it works to expand its more sophisticated ad targeting tools and reshape its systems in response to changing privacy and data restriction laws.

Apple’s 1OS 14 upgrade, which asks users whether they want to share data with an app or not, had a particularly negative effect on Snap. Given Snap’s focus on user privacy, it’s unsurprising that a lot of Snap users opted out of sharing additional info, which has forced Snap to reform its ad targeting process.

Over that time, Snap’s infrastructure costs increased by almost $50 million, which relates to the development of AI and AR, but this would also reflect the continuing cost of changing its ad targeting method to better meet partner needs.

Regarding more specific aspects, Snap claims that overall time spent watching Spotlight, its short-form video stream akin to TikTok, has more than tripled year over year, showing the format’s continued appeal.

There is a very good reason why each app looks to steal the best ideas from the others, even though feature replication may seem like cheating and a cheap tactic in the industry, as demonstrated by Snap’s claim that Spotlight now reaches more than 400 million users each month, an increase of 51% year over year.

Additionally, Snapchat+ has shown continued growth, recently surpassing 4 million paying subscribers.

Snap has seen better success with Snapchat+ than Twitter has with Twitter Blue (est. 700k sign-ups), despite Twitter making a much bigger push on its offering, which reflects both the value that Snap provides to its dedicated user base and the utility of the add-ons included in the Snapchat+ package.

Twitter Blue, which has pushed verification ticks as its main selling point, has grown to be a polarizing alternative, with Elon Musk’s supporters happy paying up and criticizing those who don’t, as if doing so is making a political statement in and of itself. Snapchat+ has adopted a more guarded stance, but due to the value that Snap offers, many users have nonetheless subscribed to S+. As a result, S+ usage is currently almost six times larger than Blue usage.

The conversational chatbot “My AI” from Snap, which was initially only available to Snapchat+ subscribers, has also attracted a lot of interest.

With this in-app feature, Snap has been able to capitalize on the growing interest in generative AI, which is popular with at least some members of its community. While developing generative visual tools as an addition to its AI features, Snap has also integrated visual aspects into My AI so that users can generate responses from the tool based on visual inputs.

Although Snap still has a ways to go until its ad business is back on track, the indicators are generally encouraging. More advertisers are testing out Snap’s expanding ad options, which will probably result in more income in the future, and more users are becoming active in new markets.

The cost of such revenue and the increase in Snap’s infrastructure spending are causes for concern. That might only happen once as part of a larger investment in platform improvement, which will open up new options. Nonetheless, that has influenced the aggregate figures for this quarter.

Source- Marketing Dive