Trade on a day when the market fluctuated, Shriram Finance Ltd experienced a 1.15% drop in its share price. At the time of writing this report, the stock of Shriram Finance was at Rs 2891.4 on Thursday at about 01:04 PM India Standard Time. The BSE Sensex fell by 419.82 points, reaching 79048.19 during the same period.

Technical Research Analyst

Nagaraj Shetti, a Technical Research Analyst at HDFC Securities, said the pattern witnessed on Monday may be categorized as High Wave. This is characteristic of high volatility in the market when prices are at swing highs. The 200 DMA had a value of 2376.95, while the 50 DMA was at Rs 2758.77. If a stock is trading above the 50 DMA and 200 DMA, it then means that the position is bullish. On the other hand, the position below both moving averages indicates a bearish outlook.

Key Challenges Faced by Shriram Finance

Shriram Finance Limited one of the leading NBFCs in India has experienced many opportunities and threats. The financial service industry in India is well developed, with different companies operating within the sector to capture as much market. Shriram Finance operates in a highly competitive market where it has to compete with many other NBFCs, which can affect its growth and profitability. Compliance with new and changed regulations while optimizing operational speed is essential. Nevertheless, owing to such difficulties, Shriram Finance still has avenues to diversify and meet the needs of its myriad clients with customized financial products.

Valuation Metrics

Shriram Finance’s shares have risen by 55.18% in the last year although it has outperformed the Sensex returning an 18.5 percent increase during the same period. The company’s stock has a price-earnings ratio of 14.2 and a P/B ratio of 1.81. A higher P/E ratio signifies that the market expects better growth rates in the future and P/B is more of the value investors’ price.

Shriram Finance Compared to Other NBFCs in India

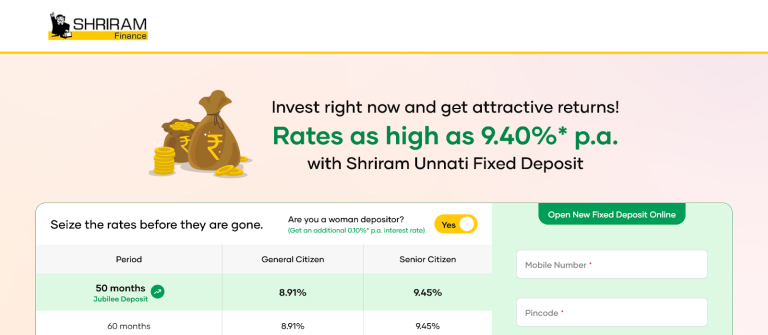

Shriram Finance is one of the leading NBFCs specializing in the retail sector in India. It focuses mainly on commercial vehicle financing making them suitable for trucking companies, construction firms, and transporters. It offers some of the best fixed deposit or FD rates in the market sometimes even better than what the normal banks offer. For example, their FD rates are higher than 7%, which is very attractive for those who invest.

This company has been accredited with the title of the ‘Great Place to Work’ and ‘Best Housing Finance Company of the Year’. Even during the pandemic, Shriram Finance managed to diversify its funds through both the Two Wheeler and Four Wheeler segments proving its flexibility as an organization. It has gained a competitive advantage from being a retail NBFC, offering attractive rates on its products, and having a reputation in the industry.

Conclusion

Shriram Finance comes under the NBFC Diversified segment which operates in a volatile financial sector. Though the markets have been volatile, Shriram Finance has continued to thrive and evolve with the flow of the marine current.

Note: You can reach us at support@scoopearth.com with any further queries.

Linkedin Page : https://www.linkedin.com/company/scoopearth-com/