The Central Consumer Protection Authority (CCPA) released recommendations on Monday to stop unfair business practises and safeguard consumers’ interests regarding the imposition of service charges in hotels and restaurants.

According to the regulations, customers can contact the number 1915 to file complaints about hotels and restaurants.

The Consumer Protection Act, 2019, established the CCPA in July 2020 to advance, defend, and uphold the rights of consumers as a group and to look into, pursue, and penalise those who violate such rights.

If a customer notices a service fee on her statement, she has four alternatives at various levels of escalation.

She might ask the hotel or restaurant to take the service fee off of her bill at the beginning.

Second, she has the option to file a grievance with the National Consumer Helpline (NCH), which serves as an alternative dispute resolution method prior to litigation. You can file a complaint by calling the number 1915 or using the NCH mobile app.

Third, the customer has two options for filing a complaint: either through the edaakhil portal at http://www.edaakhil.nic.in or the Consumer Commission.

Fourth, she has the option to file a complaint with the District Collector of the relevant district for CCPA inquiry and further action. By emailing com-ccpa@nic.in with their complaint, consumers can contact the CCPA directly.

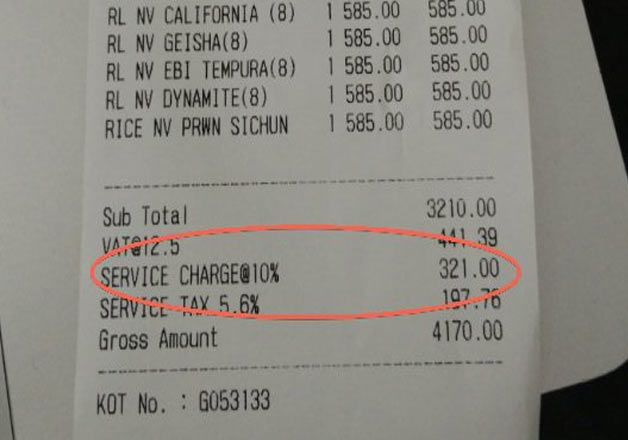

The CCPA acknowledged complaints about restaurants and motels automatically charging service fees without requesting or telling customers.

The Ministry of Consumer Affairs, Food & Public Distribution’s Department of Consumer Affairs met with restaurant groups and consumer organisations on June 2 to discuss the imposition of a service tax in hotels and restaurants.

Following the discussion, the department declared that the Center will shortly publish a “strong framework” to guarantee strict adherence to its 2017 recommendations, which forbade the imposition of service charges. A day later, Piyush Goyal, the Union Minister of Consumer Affairs, Food, and Public Distribution, declared that eateries could not impose secret fees on their patrons.

The levying of a service fee by a restaurant is a “matter of individual policy,” representatives of the hotel and restaurant sector informed the Centre on June 2 at the meeting. They stated that there is “no illegality in levying such a tax.”

Additionally, they said that because tax is paid on service charges, the government benefits financially from them.