Introduction: Revolut Founding Members

Revolut is a British monetary generation organisation that gives banking offerings. Headquartered in London, it turned into based in 2015 via way of means of Nikolay Storonsky and Vlad Yatsenko.

It gives debts presenting forex, debit cards, digital cards, Apple Pay, hobby-bearing “vaults”, commission-unfastened inventory buying and selling, crypto, commodities, and different offerings.

About:

Revolut has accelerated into new markets along with Japan and accelerated team of workers from 1500 to round 5000. In November 2020 it turned into breaking even and, with a £4.2 billion valuation have become the UK’s maximum treasured fintech organisation.

In January 2021 it carried out for a UK banking licence. A US$800 million investment spherical in July 2021 introduced organisation’s valuation to US$33 billion, making it the maximum treasured UK tech startup on the time.

Revolut Founder & Team:

Nikolay Storonsky and Vlad Yatsenko based revoult in 2015. Nik Storonsky, the Russian billionaire cofounder of London-primarily based totally monetary app Revolut, introduced on Tuesday that he opposes the Russian strugglefare in opposition to Ukraine.

He additionally stated his organisation might fit up to £1.five million (US$2 million) in donations to the Red Cross Ukraine attraction over the subsequent week.

Revolut History:

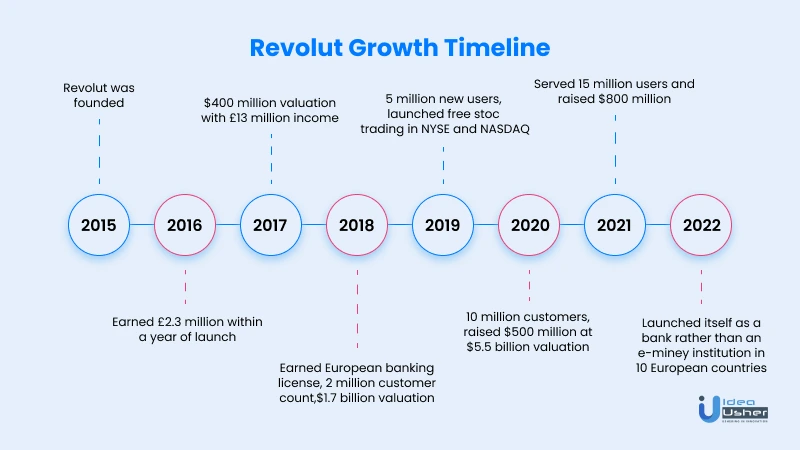

Revolut turned into based on 1 July 2015 via way of means of Nikolay Storonsky from Russia and Vlad Yatsenko from Ukraine. The organisation turned into initially primarily based totally in Level39, a monetary generation incubator in Canary Wharf, London.

On 26 April 2018, Revolut raised $250 million in Series C investment. It had a post-investment valuation of US$1.7 billion, making it a unicorn. DST Global turned into based via way of means of Yuri Milner, who has been sponsored via way of means of the Kremlin in his preceding investments.

In December 2018, Revolut secured a Challenger financial institution licence from the European Central Bank, facilitated via way of means of the Bank of Lithuania, authorising it to simply accept deposits and provide purchaser credits, however now no longer to offer funding offerings. At the equal time, an Electronic Money Institution licence turned into additionally issued via way of means of the Bank of Lithuania.

In March 2019, the organisation’s leader monetary officer Peter O’Higgins resigned. TechCrunch said that he had end following allegations of compliance lapses, but Revolut denied that he had left for those reasons.

In July 2019, Revolut released commission-unfastened inventory buying and selling at the New York Stock Exchange and NASDAQ, to start with for clients in its Metal plan. This turned into ultimately made to be had to all customers.

In August 2019, the organisation introduced numerous hires with enjoy in conventional banking, inclusive of Wolfgang Bardorf, previously govt director at Goldman Sachs and the worldwide head of liquidity fashions and methodologies at Deutsche Bank, Philip Doyle, formerly head of monetary crime at ClearBank and fraud prevention supervisor at Visa, and Stefan Wille, formerly senior vice-president of finance at N26 and company finance supervisor at Credit Suisse.

In October 2019, the organisation introduced a worldwide address Visa, following which it accelerated into 24 new markets and rent round 3500 extra team of workers.

In February 2020, Revolut finished a investment spherical that extra than tripled its value, valuing the organisation at £4.2 billion and turning into the United Kingdom’s maximum treasured monetary generation startup.

In March 2020, Revolut turned into released withinside the United States. In August, the organisation released its monetary app in Japan.

In November 2020, Revolut have become profitable.

In January 2021, the organisation introduced that it had carried out for a UK banking licence. In March 2021, Revolut carried out for a financial institution constitution withinside the US thru packages with the FDIC and the California Department of Financial Protection.

In July 2021, Revolut raised US$800 million from traders, inclusive of SoftBank Group and Tiger Global Management, at a US$33 billion valuation.

In January 2022, Revolut released as a financial institution (in preference to an e-cash institution) in 10 extra European countries: Belgium, Denmark, Finland, Germany, Iceland, Lichtenstein, Luxembourg, Netherlands, Spain, and Sweden.

In March 2022, after Russia invaded Ukraine, Storonsky publicly antagonistic the strugglefare in Ukraine and Revolut donated £1.five million to the Red Cross Ukraine attraction. Since March 2022, Revolut has extra than 18 million clients round the sector and extra than one hundred fifty million transactions a month.

Revolut Revenue:

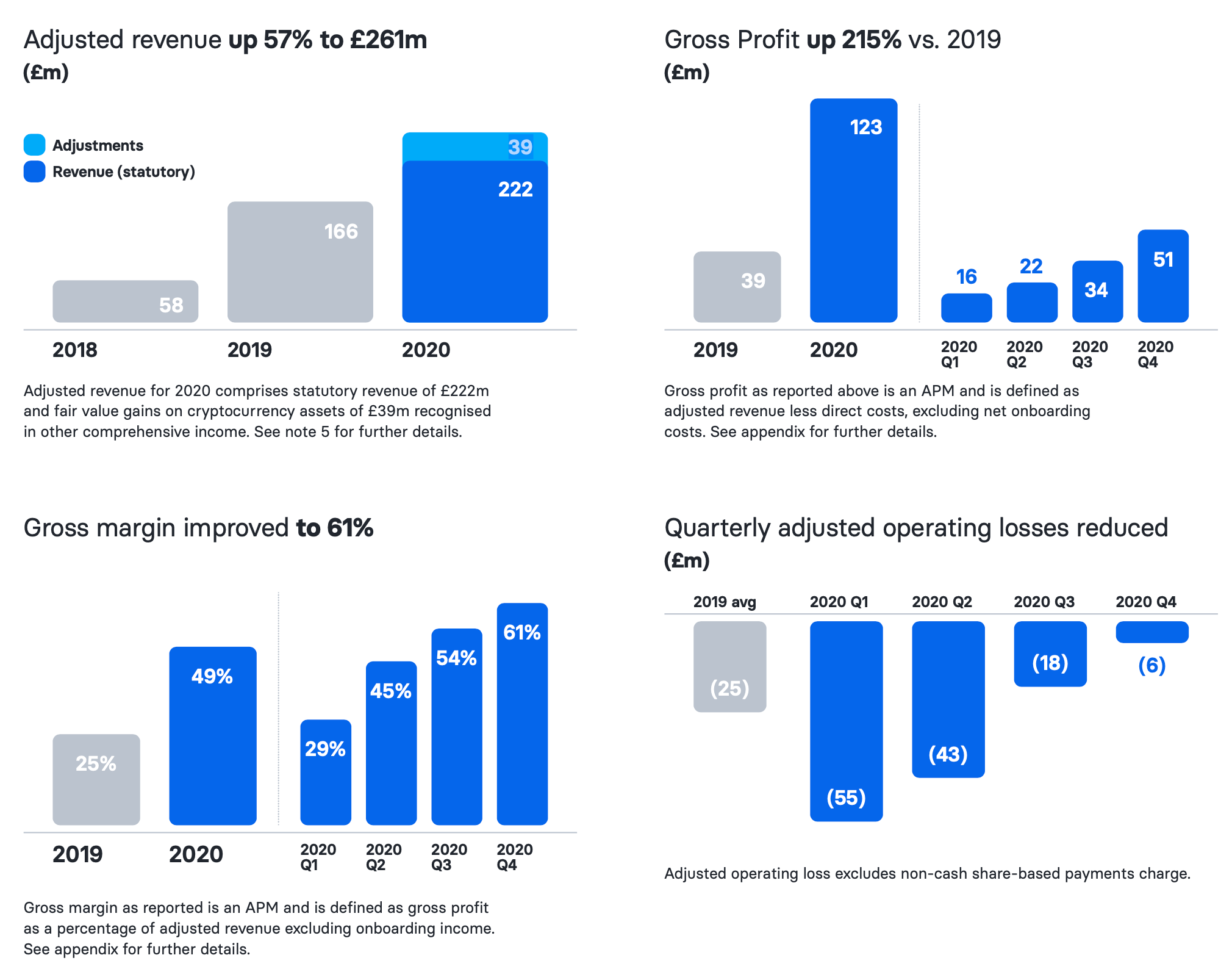

Fintech startup Revolut has filed a few monetary outcomes and is sharing information with the press. In 2020, the organisation said $361 million in sales (£261 million) — that’s a 57% growth in comparison to 2019 sales of $229 million (£166 million).

Gross income reached $a hundred and seventy million (£123 million) ultimate year. At the equal time, the organisation nonetheless reviews running losses; Q1 2020 turned into a in particular horrific quarter, with $seventy six million (£fifty five million) in adjusted running loss.

In 2020, overall non-adjusted running loss reached $277 million (£2 hundred.6 million). Like many tech companies, administrative fees are answerable for this loss. With a team of workers of 2,2 hundred people, the organisation spent $367 million (£266 million) on administrative prices alone.

Revolut Funding & Investors:

Revolut, the monetary superapp with extra than sixteen million clients worldwide, these days introduced an $800m collection E investment spherical, valuing the commercial enterprise at $33 billion. The new investment spherical brings onboard new traders, SoftBank Vision Fund 2 (“SoftBank”), and Tiger Global Management.

Revolut Revenue Model:

Revolut is a neobank that offers its clients with all of the offerings they might preference from a conventional financial institution, however with a twist. Their commercial enterprise version and the client enjoy they offer are a lot higher than what conventional banks provide.

That is the cause why neobanks have become famous worldwide. May or not it’s Volt in Australia, Monzo withinside the UK, or n26 in Germany, those answers are disrupting the banking enterprise via way of means of getting extra traction each day. Users too love them due to brought convenience.

Revolut’s commercial enterprise version is primarily based totally on numerous levers, inclusive of distinct subscription plans (for each clients and businesses), prices for worldwide transfers and withdrawals or hobby and overdraft paid on loans. Furthermore, it gives extra monetary merchandise along with buying and selling, numerous insurances in addition to a cashback program.

Services Offered thru Revolut:

Revolut gives banking offerings inclusive of GBP and EUR financial institution debts, debit cards, rate-unfastened forex, inventory buying and selling, cryptocurrency change and peer-to-peer bills.

Revolut’s cellular app helps spending and ATM withdrawals in a hundred and twenty currencies and transfers in 29 currencies at once from the app. Payments at weekends incur a further rate of 0.five% to 2% shielding them in opposition to change charge fluctuations.

It additionally gives clients get right of entry to to cryptocurrencies along with Bitcoin, Ethereum, Litecoin, Bitcoin Cash, and XRP via way of means of changing with 25 fiat currencies. A rate of 1.five% for getting or promoting applies.

Crypto can’t be deposited or spent, simplest transformed returned to fiat inner Revolut. Additionally, Revolut banks with Metropolitan Commercial Bank of New York, who do now no longer permit the switch of Fiat cash to or from cryptocurrency exchanges.

It gives an equities buying and selling facility, with get right of entry to to various US shares and fractional proportion purchase/sale. Stocks bought withinside the app can’t be transferred to every other broker, however ought to be sold/transformed returned to cash, which could then be withdrawn.

Revolut Awards & Recognition:

There isn’t anyt any praise information of Revolut.

Revolut Competitors:

Revolut’s pinnacle competition consist of Chime, Starling Bank, BrainTree, Green Dot, Monzo Bank, N26, WorldRemit, Wise and Swissquote.

Revolut Latest News:

- 24 Jun 2022: Revolut to roll out ‘responsible’ BNPL product throughout Europe

- sixteen Jun 2022: Revolut faucets Salesforce to scale its commercial enterprise banking operations

- 15 Jun 2022: Storonsky is going public over frustration with FCA

- 15 Jun 2022: Revolut opens new the front in cash switch wars

- thirteen Jun 2022: Revolut Business introduces rate-unfastened USD transfers to UK clients

- 10 Jun 2022: Revolut introduces rate-unfastened USD transfers to UK clients

- 08 Jun 2022: Money 20/20 EU: Which comes first, tech or banking?

- 07 Jun 2022: Revolut companions Tink for European bills

- 25 May 2022: Revolut rolls out fee control product

- 17 May 2022: Revolut’s Nik Storonsky to release AI-pushed VC fund

- sixteen May 2022: Revolut reviews a 215% growth in ‘silver swipers’

- 25 Apr 2022: Revolut suspends refugee referral payouts after customers recreation the system

- 14 Apr 2022: Revolut faucets Cross River to construct US biz

- 05 Apr 2022: Revolut Premium and Metal account holders now have journey coverage blessings from Allianz Partners

- 04 Apr 2022: Revolut appoints Apac standard supervisor

- 29 Mar 2022: Revolut gears up for Brazilian release

- 28 Mar 2022: Revolut expands US management team

- 14 Mar 2022: Revolut to provide charge offerings to refugees fleeing Ukraine

- eleven Mar 2022: Revolut raises €10 million for Red Cross Ukraine attraction

- 02 Mar 2022: Revolut’s Russian born leader Storonsky breaks silence over Ukraine invasion

- 19 jan 2023: Revolut is reportedly holding off on plans to launch its native crypto token, which aims to reward customers for their loyalty, as the London-based neobank is currently assessing the best time to do that.

- 20 Jan 2023: Fintech company Revolut has announced the appointment of Sandeep Nainwal as the head of people in India.

Revolut Future Plans:

Revolut, the fintech that acts as a forex and bills provider, is stated to be chasing $1 billion in price range because it appears to hold its increase and growth throughout Europe.

Some FAQs About Revolut:

Is Revolut nonetheless developing?

Nik Storonsky, Founder & CEO of Revolut, stated: “While we nonetheless have a few manner to go, we’re thrilled with our development in 2019. We tripled our revenues, multiplied retail clients from 3.five million to ten million, multiplied day by day energetic clients via way of means of 231% and the wide variety of paying clients grew via way of means of 139%.”

Is Revolut going to be a financial institution?

Revolut launches as a financial institution in 10 Western European markets, now to be had in 28 countries. Revolut, the worldwide monetary super-app with extra than 18 million clients worldwide, has operationalised its Lithuania primarily based totally European specialized banking licence in 10 European markets.

Is Revolut owned via way of means of Russian?

Revolut cofounder Vlad Yatsenko is Ukrainian; each he and Storonsky have British passports.

Will Revolut end up a financial institution in UK?

Revolut has but to get hold of a UK banking licence – partially attributable to a backlog of packages on the Bank – in spite of making use of for one early ultimate year.

Is Revolut making income?

The London-primarily based totally challenger financial institution Revolut said a internet lack of about 206 million British kilos in 2020, almost instances as a lot because the preceding years.

Conclusion:

It has additionally been branching out into the cryptocurrency marketplace as properly because it keeps to feature new cryptos into its basket and additionally permits customers to shop for and promote cryptos thru its platform the use of fiat currencies and a aggregate of bills and cryptos is the first-rate blend that traders searching for at this factor of time.

But traders might additionally appearance to Revolut to overturn its losses and flip them into earnings in double short time as it’s miles primed to achieve this aleven though it isn’t always very clean why it’s been making losses in spite of being in a developing enterprise. All those might be elements that traders keep in mind once they do determine to return back onboard.

Hi, This is Scoopearth’s admin profile. Scoopearth is a well-known Digital Media Platform. We share Very Authentic and Meaningful information based on Real facts and Verification related to start-ups, technology, Digital Marketing, Business and Finance.

Note: You can reach us at support@scoopearth.com with any further queries.

Linkedin Page : https://www.linkedin.com/company/scoopearth-com/