Overview:

| Type | Private | |

| Industry | Fintech, Financial Services, Payments | |

| Founded | 2014 | |

| Founder | Harshil Mathur and Shashank Kumar | |

| Headquarters | Bangalore , India | |

| Number of employees | 1300 | |

| Website | razorpay.com |

ABOUT RAZORPAY

Razorpay is a leading financial technology (fintech) company based in India that provides a comprehensive suite of payment and financial solutions for businesses. Founded in 2014, Razorpay simplifies payment processing by enabling businesses to accept, process, and disburse payments seamlessly through various channels.

Key Features of Razorpay:

- Payment Gateway:

- Supports multiple payment modes, including credit/debit cards, UPI, net banking, wallets, and international payments.

- Offers easy integration with websites and mobile apps.

- RazorpayX:

- A neobanking platform that provides businesses with tools for managing payroll, vendor payments, and corporate card services.

- Razorpay Capital:

- Offers financial services such as working capital loans and credit to businesses based on transaction data.

- Recurring Payments:

- Enables subscription-based businesses to automate billing and payment collection.

- Developer-Friendly Tools:

- Provides APIs and SDKs for seamless customization and integration.

- Security and Compliance:

- Adheres to PCI DSS standards for secure transactions and offers fraud detection systems.

The stage gives a far reaching dashboard to dealing with installments for clients and is appropriate for both web and versatile applications.

In 2017, the stage had sent off four items to be specific Razorpay Route, Razorpay Smart Collect, Razorpay Subscriptions and Razorpay Invoices. These items endeavor to deal with undertakings, for example, incomes, payment of cash, computerizing NEFT, bank wires as well as assortment of planned installments.

One more auxiliary endeavor of the stage is Razorpay Capital which is a loaning stage that backs organizations with moment credits to help them in settling their income issues.

The stage has likewise remembered two new elements for the administrations it offers to be specific ‘Incomplete installments’ and ‘Group Uploads’, where Partial Payments highlight allows the end-clients to perform installments in segments against a specific request ID rather than playing out the total installment together and the Batch Uploads include permits business elements to deliver and deal with joins in clumps as opposed to setting up independent connections by transferring particular documents which oblige the gather request data.

One more driving result of the stage is RazorpayX which is an AI-driven API banking stage. This item works with organizations with a completely working current record which can be embraced by them for robotizing finance, bank moves, sharing solicitations, etc.

RazorpayX Payouts, is a result of the stage which permits organizations to dispense installments from seller and client payouts to worker pay rates, effectively and speedily.

A portion of the main clients of Razorpay incorporate Oyo, Cred, Facebook, Flipkart, Zomato and Swiggy, Byju’s,Zilingo, Yatra and Goibibo, as well as the telecom goliath Airtel.

RAZORPAY FOUNDERS

“While building an adaptable startup, there are no alternate ways to progress”

– Harshil Mathur, fellow benefactor and CEO, Razorpay to Entrepreneur

Razorpay was established by Shashank Kumar as well as Harshil Mathur.

Having examined from Patna’s St Xavier’s High School, Shashank graduated with a Computer Science certification from IIT Roorkee. While learning at IIT, he likewise took up a mid year entry level position at the University of Minnesota as well as at Microsoft. He additionally participated in Y Combinator in 2015.

Before setting up Razorpay Shashank had been a product advancement engineer at Microsoft. He had likewise joined SDSLabs and taken up the post of its Vice President for a year.

Close by Shashank, Harshil is likewise an alum from IIT Roorkee and had been a worker at SDSLabs. He likewise functioned as a Wireline Field engineer at Schlumberger two or three months. By and by, Harshil possesses the place of CEO at Razorpay.

THE ORIGIN OF RAZORPAY

Harshil and Shashank had been acquainted with one another at IIT Roorkee and the team set up Razorpay in 2014. As the two reasoned the battle that new companies experienced in tolerating cash online previously, they began investigating open doors connecting with organizations supporting installment handling.

There were not very many installment handling firms in India then, at that point, and new businesses were expected to create an extensive report list.

Razorpay’s underlying group had been of only 11 individuals who used to share a singular loft as the stage’s prime supporters battled to meet and persuade in excess of 100 brokers to team up with them. The conversations had been sluggish and gone on in a tight spot for quite a while.

RAZORPAY BUSINESS MODEL

As detailed by Your Story, the stage charges around 0.25 – 0.5 percent expenses for every membership assortment exchange which happens by means of their passage. Through the set up of form 2.0, the stage has provoked various income streams heading ahead.

The organization charges however much two percent on each exchange completed by means of their installment entryway.

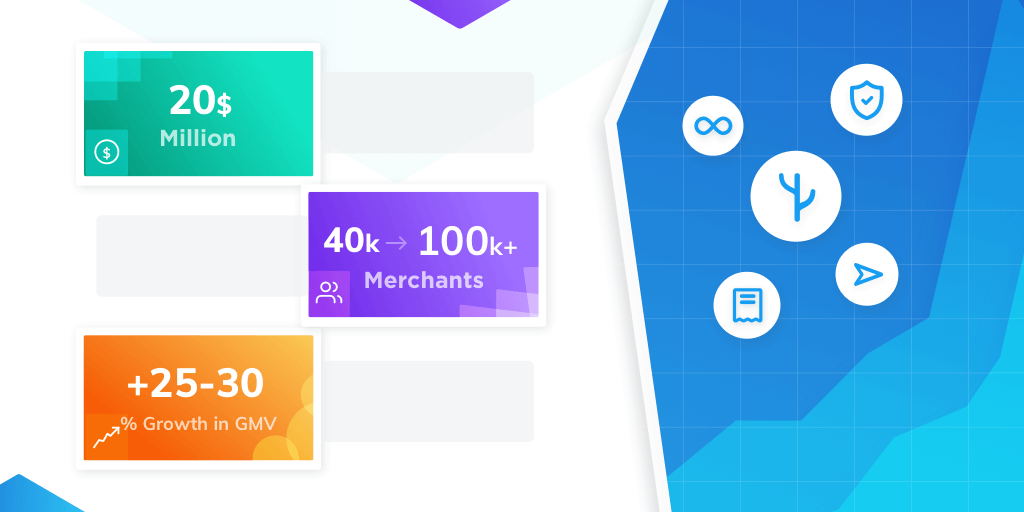

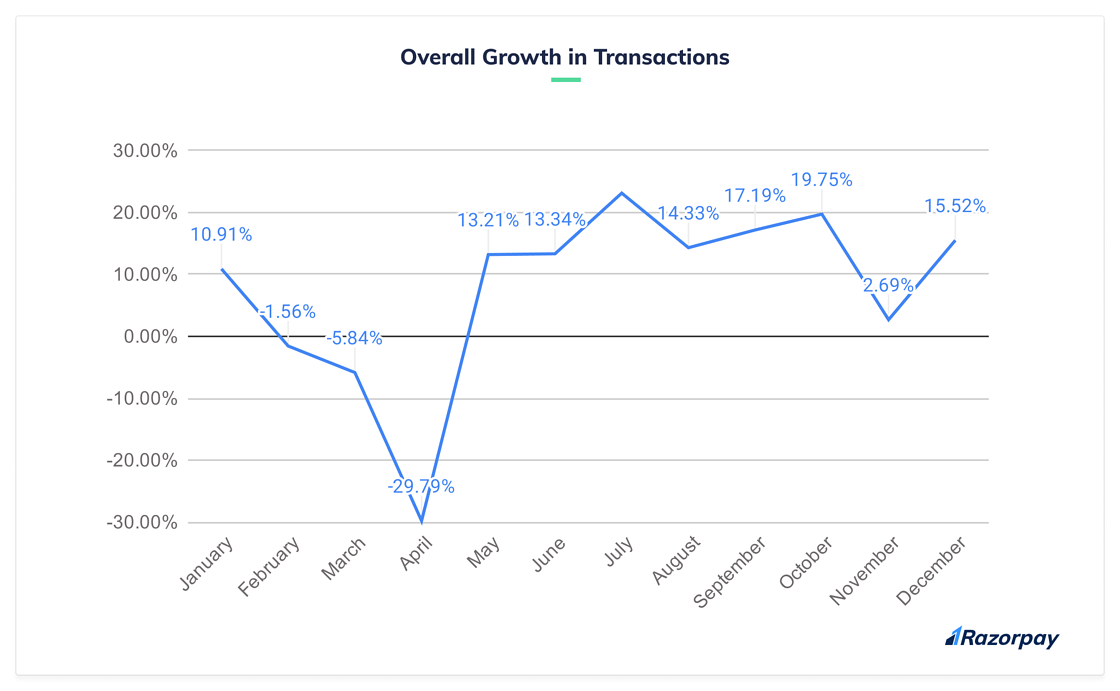

RAZORPAY’S RECENT GROWTH

In the midst of the cuts in compensations, the steady cutbacks as well as scaling back of organizations occurring because of the COVID incited limitations, a new cluster of miniature business visionaries, which likewise incorporates consultants and organizations headed by people, has been arising.

Razorpay has restricted different areas to focus on with the end goal of client procurement, which incorporate web based business, ed-tech, gaming as well as B2B new companies which are helping organizations in digitizing.

Little undertakings like supermarkets, schools and disconnected dealers who are new to online exchanges and wish to digitize theirs, are another field where the stage has found business open doors.

As of now as affirmed by TOI, the stage powers installments for around 5 million vendors which additionally incorporate Airtel, Ola, Zomato, BookMyShow, etc, conversely, with 1 million out of 2019.

As announced by Business Standard in the period of September, the stage has as of late set up a crisp loaning administration for independent ventures that are keeping watch for various approaches to accessing simple and obliging credit which would help the organizations in keeping up with constant income and furthermore in reimbursing the acquired interest with moldable timetables.

The stage has likewise set up an insurance free credit extension, ‘Loan’ for organizations. This credit extension permits MSMEs to acquire working capital with a credit breaking point of Rs 50,000 to Rs 10 lakh, inside 10 seconds through the Razorpay dashboard, as per the financial record of the business.

Razorpay has additionally as of late set up the Payment buttons item on their foundation for new companies and independent ventures. This item permits organizations as well as consultants to incorporate a solitary code line on their site or blog and go live with a coordinated installment passage, in less than 5 minutes.

The stage had set up its corporate charge card in 2019 and intends to grow to incorporate fresher organizations and corporates.

RAZORPAY FUNDING

As of late as revealed by Mint, in the period of October, Razorpay acquired $100 million in its most recent subsidizing round which was going by Singapore’s sovereign abundance store GIC as well as the stage’s current financial backer Sequoia India. With this subsidizing, the stage has joined the selective bunch of unicorn new businesses.

The stage’s driving financial backers incorporate Ribbit Capital, Tiger Global, Y Combinator, Matrix Partners, Singapore’s sovereign abundance store GIC, as well as Sequoia India.

By and by the stage is esteemed at more than $1 billion after its latest financing round. At this point, Razorpay has acquired about $206 million altogether after the entirety of its subsidizing adjusts.

RAZORPAY – AWARDS AND RECOGNITION

The different honors and acknowledgments that Razorpay got all through the years include:

- Recognized as one of India’s Top 50 Mid-Sized Workplaces in the class of “Incredible Places to Work.”

- Awarded by IAMAI as the “Best Digital Payment Facilitator.”

- Awarded by LinkedIn as India’s 25 Most Sought-after Companies to Work for.

- Was a sprinter up for the “Monetary Express Software Product of the Year.”

- The fellow benefactors Shashank Kumar and Harshil Mathur got chosen for the ‘Forbes 30 Under 30’.

- Backed the Bronze Award for the Best POS Innovation by PYMNTS.com.

- Made it in the Nasscom ‘Class of 10’ Companies.

CONCLUSION

Razorpay has emerged as a transformative force in India’s fintech ecosystem, offering innovative and comprehensive financial solutions that streamline payments and banking for businesses. With its robust payment gateway, advanced neobanking platform, and accessible lending options, Razorpay empowers enterprises of all sizes to manage their financial operations efficiently.

The company’s commitment to security, seamless integration, and customer-centric innovation has made it a trusted partner for businesses across diverse sectors. As digital payments continue to grow in prominence, Razorpay remains at the forefront, driving financial inclusion and shaping the future of commerce in India.

Note: You can reach us at support@scoopearth.com with any further queries.

Linkedin Page : https://www.linkedin.com/company/scoopearth-com/