Tuesday, 6 August 2024, Bengaluru, India

Punch, a startup based in India that provides stock trading services, has recently closed seed funding of $7 million (about INR 58.7 crores). The latest funding round was led by Stellaris Venture Partners, Susquehanna Asia VC, Prime Venture Partners, and Innoven Capital. Also, the angel investors, such as Kunal Shah, the founder and CEO of CRED, Vatsal Singhal, the co-founder of Ultrahuman, and Nitish Mittersain, the founder and CEO of Nazara, contributed to the round. There is both debt and equity portion in the funding mix.

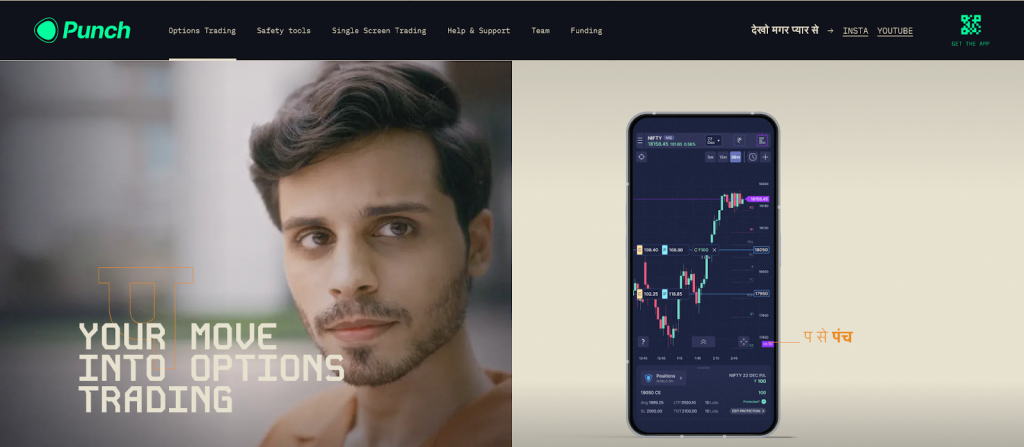

User-friendly Platform

Punch’s goal is to redefine stock trading and make it more accessible to newbies and professionals. Punch has one screen for trading and it simplifies trading processes. The program enables traders to complete orders without the need to delve through complicated GUIs. It is safe with built-in risk management tools for those traders who use it occasionally or as a part-time job. Regardless of whether you are a novice or an expert in such options, Punch guarantees the safety of the trade. Punch motivates the traders to look for the options optimistically. This is because by simplifying the trading options, the platform helps the user make informed decisions.

Punch’s Growth Trajectory

The $7 million seed funding will work as a catalyst in Punch’s growth strategy. Punch also has plans to reinvest the funds towards research and development. A priority course of action will be to build upon the features, security, and performance of the platform. The funds will be used to update Punch’s technology so that the company can continue to adapt to the competitive market. Hiring the right talents is fundamental. Punch targets to acquire the best talents that create room for innovation and customer-focused solutions.

Image Source: Punch

Enhancement of Safety for Traders

Punch’s Protection tool is aimed at helping traders on how to protect their trades and funds. It is also possible to minimize risks even if a person has no experience by following the recommendations of industry leaders. The platform also has features such as prompts and notifications to assist traders in avoiding large losses. These reminders are important especially to the newcomers as they may not know when they need to draw back.

Punch assists traders in remaining disciplined when placing orders by letting them set the number of trade limits per day or week. It discourages impulsive trading which can be disastrous because people are emotional beings and this can lead to severe losses. Punch’s safety-first approach is in line with the developments made by SEBI that highlight financial losses incurred by individual traders in Futures and Options (F&O) trading.

Punch’s Unique Selling Proposition

Punch’s Unique Selling Proposition (PUSP) offers a new approach to stock trading like the other trading platforms. Punch also enables people to purchase and sell smaller portions of company stakes. It democratizes investment because it allows everyone, including small investors, to be part of high-value stocks. It offers information and handouts to improve financial literacy.

Punch includes social aspects such that users can subscribe to other great traders, share content, etc. This makes it more of a community thing. Punch has reasonable transaction fees that make the whole process rather cheap to the users. Fixed low prices for services and operations attract occasional investors and active traders. It offers versatile research instruments, up-to-date information, and statistical data processing. It also helps users to make the correct decisions after having insights and knowledge of the existing market trends.

Conclusion

Punch enables traders to get information regarding the financial markets and use this information to trade shares effectively. Watch this space for further updates on how Punch is redefining the new paradigm of interacting with the financial markets.