Introduction:

The birth of the pandemic situation with many safety regulations like social distancing has transformed the working style of India. Digitalization and the Make in India movement have also given many start-ups and e-commerce companies. It is easier for the middle and the higher class people to access all the available online banking and financial services.

They have all the essential knowledge, resources, and experience that rural and low-middle-class families have. The lack of education, awareness, and inappropriate means of communication are the main reasons behind the restricted growth. Nearby Technologies analyzed this shortfall and brought a new revolutionary company as a solution to the market.

Pay Nearby Company Highlights:

| Founding Year: | 2016 |

| Founding Members: | Anand Kumar Bajaj, Yashwant Lodha |

| Parent Company: | Nearby Technologies Pvt. Ltd |

| Headquarters: | Mumbai, Maharashtra |

| Revenue: | $137.6 Million |

| Registered Office Address: | 1AB, Arena House, Road No. 12, MIDC, Andheri (East), Mumbai. |

| Customer Care Number: | +913366909090,+913340909090 |

| Email address: | customercare@paynearby.in |

| Website: | https://paynearby.in/ |

About Pay Nearby:

In January 2016, the Government introduced the start-up India program to transform the corporate structure and create more employment opportunities. This movement gave birth to a new fintech company called Pay Nearby, operating successfully through a B2B2C business model.

The company works to join the local retail stores with the e-commerce and banking sectors and eliminate all the financial challenges. Its “Har Dukaan Digital Pradhan” motto focuses on connecting every retail store and increasing awareness regarding insurance and mutual funds investment benefits.

Pay Nearby Specialties:

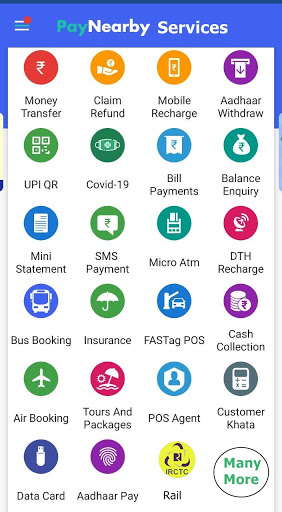

Pay Nearby offers a lot of digital, financial, and e-commerce services that facilitate the daily lifestyle of its customers. Specialties: Aadhar banking, Money Transfer, SMS Payments, Bill Payments, Recharge Services, and Khata Management. Users can make all the payments through the Aadhaar Pay app. The procedure includes selecting a machine for thumb impression, entering required details, scanning a fingerprint, and making payments. You can also download the Pay nearby Retailer app and become a part of the retail and supply chain community.

Pay Nearby Founders:

Since its formation in 2016, Pay Nearby has been striving to create India’s largest branchless banking network and provide financial services everywhere. It has a tagline, “Zidd Aage Badhne Ki.” stating the core principle of unstoppable growth and progress.

Anand Kumar Bajaj (MD & CEO) and Yashwant Lodha (Co-founder) are the two pillars behind the company’s formation. In his childhood, Anand saw many people travel long distances to avail the benefits of basic banking facilities.

Pay Nearby Mission & Vision:

In rural areas, there was limited availability and awareness of banking facilities. Since then, Anand decided to achieve all the necessary education and experience and work to improve the banking and financial sectors of the rural areas.

After completing his education, he started working as a chartered accountant in ICICI bank and Chief Innovative Officer at YES Bank. Anand met Yashwant through the large-scale remittance programs held for migrants and underprivileged people.

Growth Of Pay Nearby:

As we know about the company founders, let us discover the growth process and expansion. In April 2016, the company started its operations under the registered name of Nearby Technologies Pvt Ltd. Same year in September, the company established 2000 retail stores, served more than 1 Lakh customers, and launched Money Transfer Services.

Next year in 2017, it reached more than 3 Lakh customers, added AePS, SMS, Bill, recharge, and bus booking services, and achieved a gross transactional value of Rs. 1278 crore, and expanded its retail store business to 21500 stores.

At the end of 2018, Pay Nearby built a total of 4 Lakh retail stores, introduced accidental & personal insurance and cash collection services, and had an extended customer reach of more than three crores. In 2019, it recorded a customer reach of more than eight crores and delivery to 17000+ pin codes across India. It also launched the Micro ATM services and expanded its retail stores to more than 8, 00,000.

Throughout 2020, the company introduced the virtual prepaid card, Covid Insurance UPI QR, Saving Khata Insurance, Gold Unlocker, and multiple bank integrations. It also relaunched its website with ten language accessibility, a total of 30 Lakh retail stores, and 12.5 crores of customer outreach.

By the end of 2021, it had a customer base of 15.5 crores, 41 lakh retail stores all around, and facilities like OTP booking services, Saathi app, customer-facing application, NeoDukaan, home loan, car insurance, and customer shopping card.

Pay Nearby Associations:

Any e-commerce business needs to have a good reputation and long-term relationship with its partners to succeed. Over the years, Pay Nearby has established a valuable partnership with Axis Bank, IndusInd Bank, RBL Bank, SBM bank, YES Bank, t-hub, and YES Fintech.

In addition to these are the Telecom Sector Skill Council (TSSC), National Payments Corporation of India (NPCI), and Business Correspondent Federation of India (BCFI). It also has associations with Skill India, TRRAIN CIRCLE, IFMR, Retail Association of India (RAI), Department of Industrial Policy & Promotion (DIPP), and Retailers Association’s Skill Council of India (RASCI).

Pay Nearby Banking Services:

Pay Nearby offers more than 25+ services, out of which the topmost service includes banking and digital services. Let us dive deeper into this section and know the benefits and features it has to offer. All the transactions done from this platform are safe and certified under the ISO 27001 certification, so there are almost zero percent chances of fraud. Popular banking services include savings, cash deposits, withdrawals, money transfers, loans, and insurance.

The users can withdraw government relief funds from their banks using an Aadhar-enabled Payment Service (AePS). Micro ATM allows cash withdrawal from more than 1000 banks using various debit cards. Through Digi Smart, Transfer service users to transfer and withdraw money without any wallet balance.

You can also buy a loan in exchange for gold at an affordable lowest cost of Rs. 10000/- and rate of interest. Digital Gold purchasing facility is also available starting from the lowest price of Rs. 500/- per transaction.

Pay Nearby Digital Services:

In the pandemic era, all services have started collaborating with digital platforms. The Pay Nearby digital payment service allows local and offline businesses to convert and scale online. Establishing online stores increases the customer reach and profitability of any business. Customers get to select from a large category according to their convenience and get their orders delivered at home.

The shopkeepers can send the payment link to their customers through SMS services and accept payments using Aadhar biometrics. UPI QR Code scanning and Pay Nearby shopping Card are also available payment systems.

Pay Nearby Insurance Services:

We are never sure of the unforeseen circumstances we will face in the future. So, every individual needs to secure their life by purchasing health, medical, and general insurance policies. The platform provides a wide range of insurance premium plans for personal accidents, bike insurance, and mobile device protection at an affordable rate.

Through pay nearby, users can book bus, flight, rail, and hotel tickets and pay necessary bills like DTH, gas, water, electricity, EMI, and mobile recharge. Customers can also enjoy online shopping, gaming, education, and music/video streaming facilities available through Pay Nearby.

Pay Nearby Job Openings:

Pay Nearby provides equal opportunities to the aspirants willing to be a part of its working culture. It aims to create an innovative, interactive, empathic, ambitious, empowering, collaborative, and comfortable working environment. Here the employees can build new financial tools, provide suggestions for improvement, offer out-of-the-box solutions, and achieve new heights and milestones.

Interested candidates can apply for current job openings for business managers, software engineers, product managers, marketing managers, and Training coordinators. You can also fill up for .NET senior software engineer, application support L2, senior UI&UX designer, and enterprise sales area manager.

Pay nearby follows an open door policy, offers valuable ownership rewards, and emphasizes the professional growth of its NBTians.

PayNearby Corporate Solutions:

Pay Nearby caters to all types and sizes of businesses ranging from small-scale shops to large-scale enterprises. Features: quick automation, real-time customer analytics, reliable transaction systems, and an easy user interface. The company focuses on digitalizing cash collection, increasing market connections, and digitalizing order placement.

It also emphasizes retail audit & optimization, digitalizing loan disbursal & salary/vendor payments, invoice reconciliation, product sampling, and customer surveys. Swiggy, Bajaj Finance, Svatantra, Centrum Microfinance, and Hero FinCorp Pvt. Ltd follows Pay Nearby’s corporate solutions.

FAQs PayNearby:

What is Pay Nearby Company?

Pay nearby is a fintech company that works to join the local retail stores with the e-commerce and banking sectors and eliminate all the financial challenges.

Who are the founding team members of the company?

Anand Kumar Bajaj and Yashwant Lodha are the founding team members of the company.

Since when and from where does Pay Nearby manage its operations?

Since 2016, Pay Nearby is operating from its headquarters in Mumbai, Maharashtra.

Under which name is the company registered?

Pay Nearby is operating under the jurisdiction of its parent company Nearby Technologies Pvt Ltd.

What is the tagline of the company?

Pay Nearby has a tagline “Zidd Aage Badhne Ki.” stating the core principle of unstoppable growth and progress.

What business model does the company follow?

It follows the B2B2C business model and has the motto “Har Dukaan Digital Pradhan”.

What are the principal services provided by the company?

Special services offered by Pay Nearby are Aadhar banking, Money Transfer, SMS Payments, Bill Payments, Recharge Services, and Khata Management.

What contribution has Pay Nearby made to improve the financial sector of India?

The company works to join the local retail stores with the e-commerce and banking sectors and eliminate all the financial challenges. It also connects every retail store and increases awareness regarding insurance and mutual funds investment benefits.

What are the corporate solutions offered by Pay Nearby?

Corporate solutions include quick automation, real-time customer analytics, reliable transaction systems, and an easy user interface. The company focuses on digitalizing cash collection, increasing market connections, and digitalizing order placement.

Is it safe to use the Pay Nearby application for transferring money and paying necessary bills?

All the transactions done from this platform are safe and certified under the certification ISO 27001, so there are almost zero percent chances of fraud.

Conclusion:

The combined expertise and the launch of the Government Startup scheme led to the formation of Pay Nearby. To date, it has a 28% market share in AePS, 20 Lakh daily transactions, and 50 lakh application downloading records. The current achievements include services in 28 states, eight union territories, and 17,600 pin codes all over India.

Recent recognitions include the BFSI Excellence Award (2022), Great Place to Work Certification (2022), Retech Start-up Award (2021), Dream Company to work for (2021), Fintech Start-up of the Year (2021), and Fastest Growing Digital in Kirana Segment (2021)

Note: You can reach us at support@scoopearth.com with any further queries.

Linkedin Page : https://www.linkedin.com/company/scoopearth-com/