Introduction

India’s top-value e-commerce platform, ONECARD, has assisted the country’s e-commerce industry in expanding beyond simply companies and city dwellers throughout the years. Owner of a fintech business that aimed to offer a credit card that was updated for the smartphone age. Customers can have a fully digital experience and choose which rewards they want to receive because of the company’s control over every aspect of credit cards, which includes credit limit, instant rewards redemption, domestic and international use, online or offline transactions, contactless payments, and more.

Company Highlights

| Company Name | OneCard |

| Headquarter | Pune, India |

| Industry | Financial Services |

| Founded | 2019 |

| Founder | Rupesh Kumar, Anurag Sinha, Vibhav Hathi |

| Website | https://www.getonecard.app/ |

About

OneCard is a fintech startup that provides a credit card and credit score application optimized for mobile devices. It Provides an app that lets users manage all the features of credit cards, such as contactless payments, instant reward redemption, international or domestic use, credit limit, and online/offline transactions. It provides a feature-rich mobile app with dedicated controls for managing many parts of credit cards, including rewards, sophisticated card controls, swipe-to-pay, EMI management, and fast virtual credit card activation. Offers reward points to customers as part of a loyalty program, which they can then use to make future purchases.

Industry

OneCard operates in the FinTech market sectors, providing B2C services.

Founder and Team

OneCard was founded in 2019 by Rupesh Kumar, Anurag Sinha, and Vibhav Hathi.

OneCard – Startup Story

With OneCard’s credit card, customers may manage every aspect of a credit card, including contactless payments, online and offline use, transaction limits, and domestic and international use, among many other advantages. In light of this, certain estimates indicate that Deloitte projects the value of the Indian FinTech sector to be $180 billion. Moreover, it was claimed that the worldwide fintech industry generated income of approximately $90.5 billion, and this number has continued to rise. In 2019, three seasoned bankers, Rupesh Kumar, Anurag Sinha, and Vibhav Hathi, established OneCard. To enable consumers to monitor their credit score, FPL Technologies also operates the “OneScore” app. There are roughly 70 million users of this software.

Mission and Vision

“To be India’s Best Metal Credit Card” is the stated goal of OneCard.

Name, Tagline, and Logo

India’s Finest Metal Credit Card is the OneCard Credit Card.

OneCard – Business Model

OneCard’s innovative mobile-based application approach has revolutionized the credit card industry since its founding in 2019. The company mainly works in the Business-to-Consumer (B2C) market and partners with major banks such as IDFC First Bank, Federal Bank, and SBM Bank. Its goal is very clear: to offer new customers a mobile-only, virtual credit card that will improve their credit scores and financial experience in general.

The main focus of OneCard’s operations is educating those who are unfamiliar with credit cards. The startup offers customers smartphone access to virtual credit cards. This calculated action not only fits in with the mobile-first lifestyle of the current age but also gives consumers a tool to raise and maintain their credit scores.

For transactions over Rs 3,000, OneCard also provides an Equated Monthly Installment (EMI) service with affordable interest rates and flexible payback choices that range from three to twenty-four months.

The technology stack of the mobile application is made to be transparent, giving consumers information about their transactions, credit card bill due dates, and rewards. OneCard is a reward program that goes above and beyond the typical credit card experience.

Customers that participate in this program receive significant points for each transaction, which they can then use toward future purchases. Personalized advantages and easy-to-use features set OneCard apart in the competitive fintech market.

OneCard – Revenue Model

Interest and fees: In FY23, OneCard’s revenue-sharing model with partner banks is based on the sale of business support services, which is the company’s only source of income.

Advertising and promotion: In FY23, OneCard’s advertising and promotion costs increase by 2.6X to Rs 324 crore from Rs 124 crore in FY22. OneCard charges an annual fee for its credit cards and earns interest on balances that are not paid off in full each month.

OneCard – Products and Services

OneCard offers a credit card and credit score application optimized for mobile devices. OneScore, the company’s product, gives consumers access to credit reports, insights, and scores to help them manage their credit. Both enterprises and consumers can use its services.

OneCard – Funding and Investors

Funding

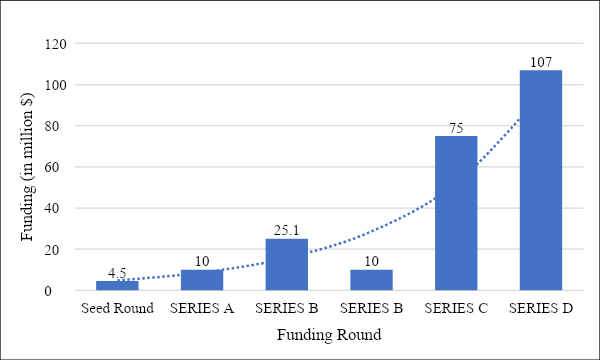

- Through six rounds of fundraising, OneCard has raised $223 million in total.

- On July 12, 2019, it held its first investment round.

- On January 4, 2024, a Conventional Debt round of $11.4 million was their most recent funding round.

- Its most recent round included one investor, Alteria Capital.

| DATE | FUNDING ROUND | AMOUNT | INVESTORS |

| September 5, 2019 | Seed Round | 4.5 | Matrix Partners, Sequoia Capital India |

| August 18, 2020 | SERIES A | 10 | Matrix Partners India, Sequoia Capital India |

| February 5, 2021 | SERIES B | 25.1 | Sequoia Capital |

| April 9, 2021 | SERIES B | 10 | QED Investors |

| December 30, 2021 | SERIES C | 75 | QED Investors |

| July 13, 2022 | SERIES D | 107 | MacRitchie Investments |

Investors

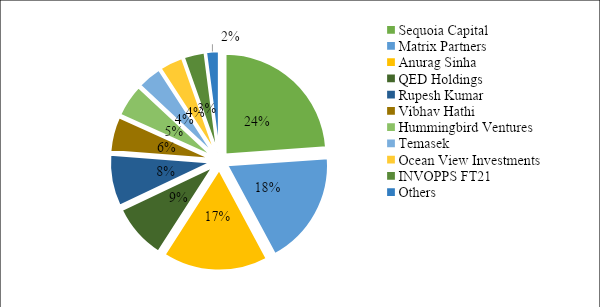

- There are fifteen institutional investors in OneCard, including QED Investors, Sequoia Capital, and Matrix Partners India.

- The biggest institutional investor in OneCard is Matrix Partners India.

- OneCard has 14 other angel investors in addition to Shivashish Chatterjee.

Share Holding

| Share Holder | Share % |

|---|---|

| Sequoia Capital | 23.37% |

| Matrix Partners | 17.9% |

| Anurag Sinha | 16.57% |

| QED Holdings | 8.67% |

| Rupesh Kumar | 8.1% |

| Vibhav Hathi | 5.4% |

| Hummingbird Ventures | 5.1% |

| Temasek | 3.8% |

| Ocean View Investments | 3.67% |

| INVOPPS FT21 | 3.3% |

| Others | 2% |

Employees

As of October 23, OneCard employed 803 people.

Challenges Faced

The competition from UPIs is one of OneCard’s greatest obstacles. Retail banks are the ones who design UPIs, and they are becoming more and more popular. While the swift implementation of UPI resulted in a decrease in the utilization of debit cards, credit cards seem to be more resilient. It is anticipated that some credit card startups would suffer from the central bank’s recent directive, which states that co-branding partners for credit cards should only be involved in card distribution and marketing as well as providing access to the cardholder for the products and services that are offered. In addition, the integration of credit cards with UPI suggests that credit card usage would rise, but it also presents a challenge to their business model because it is unclear what the merchant discount rate (MDR) will be for these kinds of charges.

Acquisitions

OneCard was bought by Capital Float.

Growth

OneCard reached a noteworthy milestone as of the fiscal year 2021 when its yearly income surpassed Rs 10 crore. Nevertheless, this remarkable expansion was accompanied by higher expenses, which climbed by 4.3X to Rs 33.15 crore.

The financial dynamics emphasize how OneCard’s operations are dynamic, highlighting how crucial sound financial management is to maintaining the company’s growth trajectory.

Partners

A number of providers, including BoB Financial, CSB Bank, Federal Bank, SBM Bank, South Indian Bank, and Indian Bank, are partners of OneCard.

Competitors

OneCard may face competition from companies such as Xiaoyusan, Uni Cards, Galaxycard, Zhongshunyi Financial, and Foresite Capital.

Conclusion

OneCard’s dedication to innovation, openness, and customer-focused solutions is still apparent as it faces obstacles and contends with competitors in the sector. The ever-changing fintech world necessitates flexibility and innovative approaches, and OneCard appears well-positioned to meet these demands.

OneCard is continuing its mission to reinvent credit solutions for the mobile generation with the help of a strong shareholder structure, effective marketing campaigns, and tactical alliances with banks. OneCard will surely continue to expand and have an impact on the changing financial ecosystem in the years to come.

FAQs

What does OneCard do?

To go along with your real OneCard credit card made of metal, the OneCard App provides a virtual credit card. It is also a credit card with VISA support that you may use for purchases and transactions made through apps or the Internet.

When was OneCard founded?

It was established in 2019.

Who is the founder of OneCard Corporation?

The OneCard was founded by Rupesh Kumar, Anurag Sinha, and Vibhav Hathi.

Who is the CEO of OneCard Corporation?

The CEO is Anurag Sinha.

Who are the main competitors of OneCard?

Foresite Capital, Zhongshunyi Financial, Uni Cards, Galaxycard, and Xiaoyusan are possible rivals to OneCard.

Ankit Kataria is an experienced content writer with over 2 years of expertise in crafting insightful articles on startups, trending topics, business, economy, and finance. With a keen eye for detail and a passion for delivering well-researched content, Ankit ensures that his articles are engaging, informative, and valuable to readers. His writing style blends analytical depth with clarity, making complex topics easily understandable for a broad audience.