Introduction:

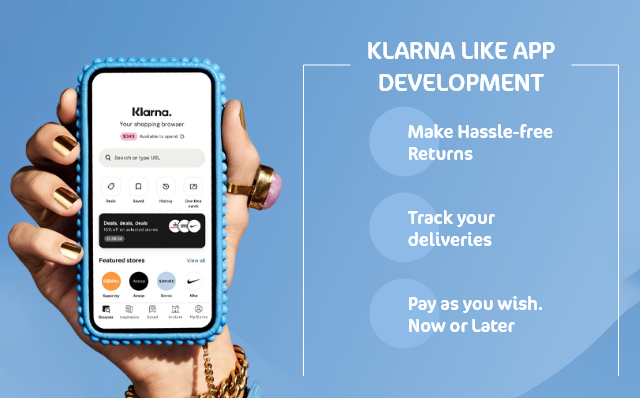

The financial technology business Klarna enables customers to make purchases using a temporary Visa card. Thus, it follows that with a soft credit check before paying the retailer. By charging retailers, Klarna generates revenue. In addition, Klarna receives a commission from interchange fees and interest on clients’ accounts.

About:

Providing 150 million active customers with better and more flexible shopping and buying experiences across more than 450,000 merchants in 45 countries, Klarna is the top global payments and shopping provider. Customers can pay when and how they want with Klarna’s direct payments, pay-after-delivery choices, and installment plans in a simple one-click purchasing process.

The Klarna Group was established in 2014 when the company bought SOFORT. Investors, including Sequoia Capital, Silver Lake, Bestseller Group, Dragoneer, Permira, Visa, Ant Group, and Atomico, are supporting Klarna.

Known simply as “Klarna,” Klarna Bank AB is a Swedish fintech business that offers online financial services such as direct payments, payments for online stores, and post-purchase payments.

More than 4,000 people work for the business, the majority of whom are located in the Stockholm and Berlin offices. The corporation handled online sales worth about US$80 billion in 2021. Around 40% of all Swedish e-commerce sales as of 2011 were conducted through Klarna. The corporation had a worth of $45.6 billion in 2021, making it the most valuable private technology company in Europe. In 2022, its value dropped to $6.7 billion.

Website : https://www.klarna.com/international/

Founder & Team:

In order to make internet shopping simpler, Klarna was established in Stockholm, Sweden, in 2005. Although technology has changed, excited, and transformed the world in the past 17 years, our objective to make paying as easy, secure, and above all, smooth remains as vital as ever. Victor Jacobsson, Niklas Adalberth, and Sebastian Siemiatkowski were responsible for its creation.

History:

The first transaction that the Klarna platform facilitated took place at the Swedish bookstore Pocketklubben on April 10, 2005. On the original Klarna website, customers may get an invoice in the mail within 30 days after placing an online order. This made eCommerce, which was still in its infancy in 2005, more appealing to individuals who were tired of the idea and thus increased retail sales.

Today, Klarna is unquestionably a fintech business; according to a TechCrunch story, in late 2020, about 37% of its 3,500 employees were software programmers. The entire business is now cloud-based, and numerous automated procedures handle everything from the shopping app to the credit scoring algorithms. The company’s purchase now, pay later (BNPL) option is possibly the most well-known.

Klarna Highlight:

| Company Name | Klarna |

| Founders | Sebastian Siemiatkowski, Victor Jacobsson, and Niklas Adalberth |

| Started at | 2005 |

| Competitors | Sezzle.PayPal Credit.Affirm.Afterpay.Zip.Splitit.PayPal.GoCardless. |

| Website | https://www.klarna.com/us/ |

| Revenue | $1.42 billion |

| Country | Sweden |

| Customer care Email | – |

| Customer care Contact details | – |

| Company Valuation | – |

| Industry | Payment/ Transaction |

| Headquarters | Stockholm, Sweden |

Revenue:

Revenue for Klarna rose by 32% to $1.42 billion in 2021. The majority of its revenue is derived through the interchange and merchant fees.

Funding & Investors:

Over the course of 28 rounds, Klarna has raised a total of $4.5B in investment. Their most recent funding came from a Venture – Series Unknown round, which was raised on July 11, 2022. 69 investors have provided money to Klarna. The most recent investors include Sequoia Capital and the Canada Pension Plan Investment Board.

Business Model:

To drive revenue, Klarna very much relies on charging the merchant as opposed to the consumer.

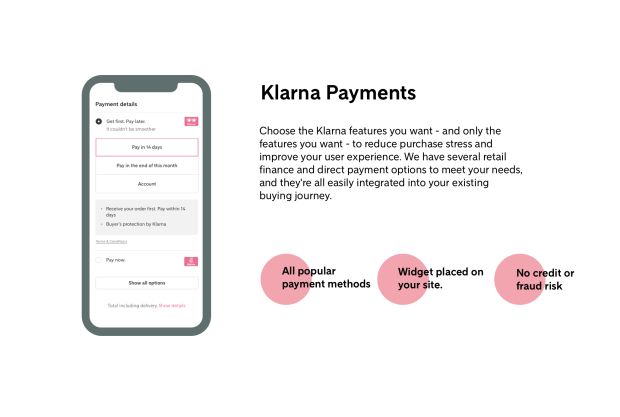

Payment fees

Variable percentage fees and merchant transactions provide for the majority of Klarna’s income. These charges vary depending on the customer’s payment method and home country. For instance, in the United States, merchants are required to pay Klarna a 30-cent transaction fee in addition to a variable cost ranging from 3.29 to 5.99 percent.

Interchange fees

In conjunction with Visa, Klarna recently introduced a bank account feature and gave users a free debit card. An interchange fee (usually approximately 1 percent) is paid by the merchant to the card issuer whenever a customer makes an eligible purchase. After that, Klarna keeps a percentage of the interchange charge in return for recommending Visa to its clientele.

Cash interest

By lending the money in those accounts to other organizations via the aforementioned bank account function, Klarna makes money off of it.

Services Offered thru Klarna:

The primary service offered by Klarna is the management of client payments and store claims in the e-commerce sector. It has earned a reputation as a “Buy now, pay later” (BNPL) service provider by providing credit to customers throughout the checkout process.

Awards & Recognition:

It is an enormous pleasure for Klarna to get the “Epic Brands” award in 2020. The business won the bank division.

Controversy:

In the UK, Klarna competes in the quickly expanding post-payment industry, which has come under fire for enticing consumers to accumulate unmanageable amounts of debt. The UK Government declared in February 2021 that the Financial Conduct Authority of the UK would henceforth be in charge of regulating this industry.

In Sweden, the Swedish Consumer Agency received a lot of complaints about Klarna in 2014. Many clients had been threatened with debt collection and charged reminder costs without ever receiving a legitimate invoice. Since the company gained money from these reminder fees and Klarna also had a division devoted to debt collection, it was questioned whether this was an unethical business model.

Competitors:

Top 10 Alternatives to Klarna

- Sezzle.

- PayPal Credit.

- Affirm.

- Afterpay.

- Zip.

- Splitit.

- PayPal.

- GoCardless.

Latest News:

There is no data on it.

Future Plans:

There is no data of it.

Some FAQs:

What has happened to Klarna?

Staff members were given voluntary redundancy and severance pay by Klarna. A Sifted study found that the departments most affected by the layoffs were talent acquisition, engineering, and business development. The majority of the affected employees were headquartered at the company’s headquarters in Stockholm.

Is Klarna losing money?

Since 2015, Klarna’s profits have been diminishing; they went into the red in 2019, and then they quadrupled to $730 million by 2021.

Is Klarna making a profit?

Only when a customer chooses to spread out the expense of a purchase over several months does the business receive payment from them. In addition to customary transaction and payment fees, Klarna receives a commission based on interchange fees.

Why did Klarna lose value?

Investors’ abrupt voting in the opposite direction from how they had been voting for the previous few years, according to Michael Moritz, partner at venture capital company Sequoia, is the sole cause of the change in Klarna’s valuation.

What company owns Klarna?

Known simply as “Klarna,” Klarna Bank AB is a Swedish fintech business that offers online financial services such as direct payments, payments for online stores, and post-purchase payments.

Conclusion:

In 2022, Klarna, Affirm, and Afterpay will be some of the biggest and most well-known BNPL providers, although their business models differ slightly from one another. While Affirm will charge interest if a buyer selects the monthly payment option, Klarna and Afterpay don’t if the customer pays their bills on time. Both Klarna and Afterpay impose late fees for failed payments. Contrarily, Affirm only elects to forbid customers from making further transactions.

Hi, This is Scoopearth’s admin profile. Scoopearth is a well-known Digital Media Platform. We share Very Authentic and Meaningful information based on Real facts and Verification related to start-ups, technology, Digital Marketing, Business and Finance.

Note: You can reach us at support@scoopearth.com with any further queries.

Linkedin Page : https://www.linkedin.com/company/scoopearth-com/