Introduction:

A cryptocurrency exchange created by and for traders is called FTX. FTX provides cutting-edge products, such as leveraged tokens, options, volatility products, and derivatives, that are firsts in the market. We work hard to create a platform that is both reliable for expert trading organizations and user-friendly for beginners.

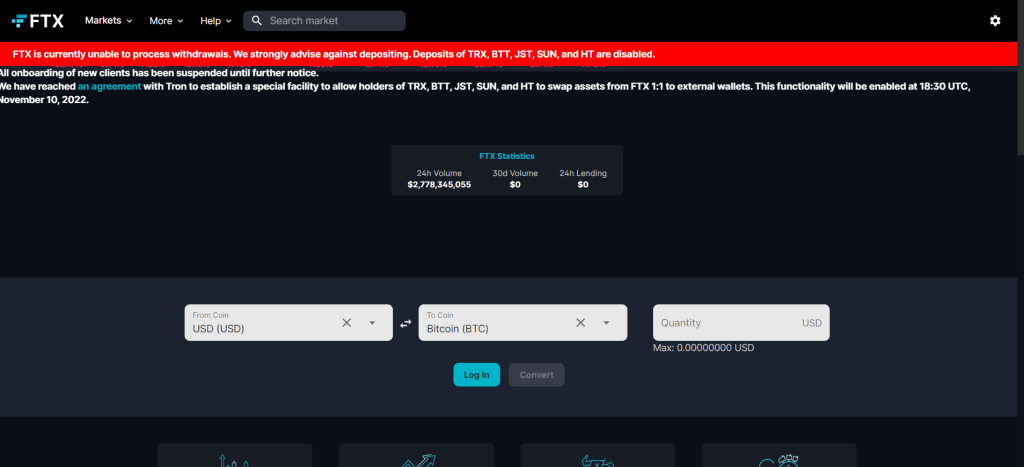

A significant cryptocurrency exchange called FTX and its American subsidiary, FTX.US, have filed for Chapter 11 bankruptcy, the firm said on Friday. The press announcement stated that founder and CEO Sam Bankman-Fried had left; the new CEO is John J. Ray III, who, around 20 years ago, oversaw the bankruptcy and liquidation of the famed energy company Enron.

The exchanges collapsed amid worries about liquidity and claims of money being misappropriated, which was followed by a significant amount of withdrawals from alarmed investors. When the value of FTX’s native token, FTT, fell, other coins, like Ethereum and Bitcoin, which as of Wednesday afternoon, had hit a two-year low, also fell along with it.

About:

A Bahamian cryptocurrency exchange is called FTX. FTX is headquartered in The Bahamas and was incorporated in Antigua and Barbuda. The exchange was established in 2019 and had more than a million users as of February 2022. Additionally, FTX ran FTX.US, a different exchange open to citizens of the United States. Since November 11, 2022, FTX has been involved in bankruptcy proceedings in US courts.

Prior to its collapse into disaster in 2022, FTX was regarded as one of the most reliable and reputable companies in the cryptocurrency sector. According to a CoinDesk story from November 2022, the associated company Alameda Research invested a sizable amount of its assets in FTX’s native coin, FTT. In response to this information, the CEO of a competing exchange, Binance, Changpeng Zhao, declared that Binance would divest its shares in FTT.

It was followed by a subsequent decline in the price of FTT and an immediate decline in FTX. Binance signed a letter of intent to purchase FTX amid the subsequent liquidity problem at the company, with due diligence to follow. The following day, they withdrew their offer. On November 11, 2022, FTX filed for Chapter 11 bankruptcy protection.

Website : https://ftx.com/

Founder & Team:

In May 2019, Sam Bankman-Fried and Gary Wang established FTX. FTX started inside Alameda Research, a trading company established by Bankman-Fried and colleagues in Berkeley, California, in 2017. The futures Exchange is referred to by the acronym FTX. After Bankman-Fried and Wang founded the company, half a year later, Changpeng Zhao of Binance bought a 20% investment in FTX.

History:

- Blockfolio, a cryptocurrency portfolio tracking tool, was purchased by FTX for $150 million in August 2020.

- In July 2021, FTX raised $900 million from more than 60 investors, including Softbank, Sequoia Capital, and other companies, at a valuation of $18 billion. Competitor Binance sold its interests in the company in 2021 after making an investment there in 2020.

- FTX relocated its corporate headquarters from Hong Kong to The Bahamas in September 2021.

- FTX announced a $2 billion venture fund called FTX Ventures on January 14, 2022. The FTX Ventures website was taken down in November 2022.

- At a $32 billion value, FTX raised $400 million in Series C fundraising in January 2022.

- FTX.US declared on February 11, 2022, that it would shortly start providing stock trading to its US clients.

- A gaming section that would assist video game producers in incorporating cryptocurrencies, NFTs, and other blockchain-related features into video games was said to be created by FTX in February 2022.

- It was revealed in July 2022 that FTX had reached an agreement with an option to purchase BlockFi for up to $240 million. BlockFi received a $400 million credit line as part of the agreement.

- Following FTX president Brett Harrison’s tweet suggesting otherwise, the Federal Deposit Insurance Corporation (FDIC) published a cease-and-desist letter accusing FTX of making “false and misleading claims” about FDIC insurance in August 2022. Harrison removed the tweet after receiving the letter, and Bankman-Fried added clarification that FTX is not covered by the FDIC in a subsequent tweet.

- On September 26, 2022, FTX.US was announced as the winner of the auction for the digital Voyager Digital, a failed cryptocurrency brokerage that has assets. The sale was worth roughly $1.42 billion, which included $1.31 billion in bitcoin held by Voyager and an additional $111 million in cash. Voyager’s creditors and the bankruptcy courts both had to approve the agreement.

- Brett Harrison, the president of FTX.US, said on September 27, 2022, that he would retire from his active position at the exchange but continue to serve as an advisor. Harrison, who has served as FTX.US president since May 2021, was not immediately succeeded by anyone.

- According to a report from October 2022, FTX was being looked into in Texas for allegedly marketing unregistered securities.

FTX Highlight:

| Company Name | FTX |

| Founders | Sam Bankman-Fried and Gary Wang |

| Started at | 2019 |

| Competitors | Square Point of Sale.Lightspeed Retail.Shopify POS.Heartland Retail.QuickBooks Point of Sale.LS Retail.Tessitura.Clover. |

| Website | https://ftx.com/ |

| Revenue | INR 679.10 cr |

| Country | Caribbean |

| Customer care Email | – |

| Customer care Contact details | – |

| Company Valuation | $32 billion |

| Industry | Cryptocurrency |

| Headquarters | Nassau, The Bahamas |

Revenue:

According to regulatory papers obtained from Tofler, the startup’s operating revenues nearly doubled to Rs 679.1 crore in FY22.

Funding & Investors:

- Exchange for crypto derivatives The Wall Street Journal claimed that FTX had established a $2 billion fund to invest in entrepreneurs in the cryptocurrency sector, citing Amy Wu, the fund’s manager. Wu later tweeted to confirm the action.

- According to the research, FTX Ventures is one of the biggest funds in the sector. Sam Bankman-Fried, the company’s creator, and FTX provided the entire capital. The amount of investment might range from $100,000 to hundreds of millions of dollars.

- The fund could use all of the cash by next year, according to Wu, who joined FTX last month from Lightspeed Venture Partners, but that depends on the opportunities that FTX sees in the market. FTX raised $420.7 million and had a $25 billion valuation in October.

- Wu told the Journal that she is particularly interested in insurance and security solutions, as well as cryptocurrency gaming companies.

- FTX Ventures joins funds established by other cryptocurrency exchanges, including the long-running Coinbase Ventures and Binance Labs.

- As bitcoin values increased over the previous year, funds devoted to cryptocurrencies grew rapidly. The biggest fund in the cryptocurrency sector, worth $2.5 billion, was introduced in November by Paradigm.

Business Model:

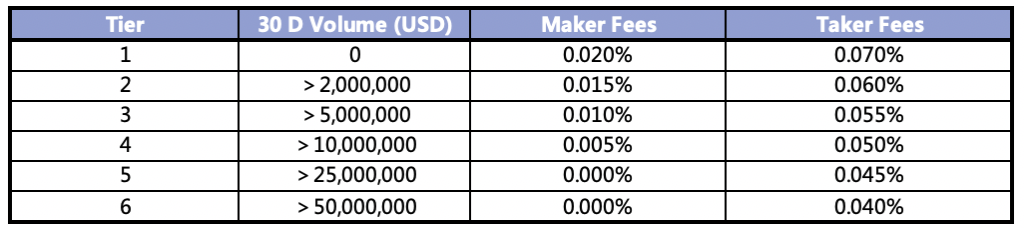

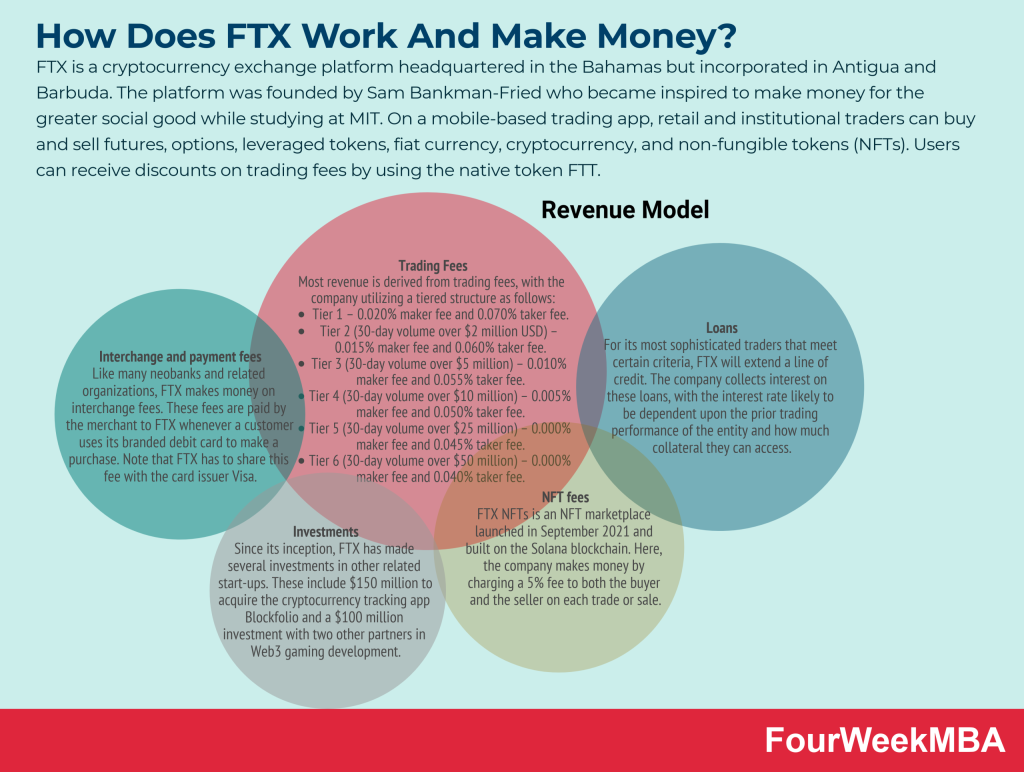

By charging a variety of trading fees, charging interest on loans, charging interchange and payment fees, charging listing and transaction fees through its NFT marketplace, and selling stock in the companies it invests in, FTX generates revenue. The various fees that FTX charges whenever users trade on its platform account for the vast majority of its income.

When a user stakes FTT or contributes their cryptocurrency assets to a blockchain network and transaction confirmation, these fees are lowered. Users can already lower their maker fees to 0% with all except 25 FTT staked. Taker costs can even be lowered to as little as 0.015 percent, depending on how much is being staked.

On the site, users can borrow money to leverage their bets (so-called margin trading). After then, borrowers have assessed a daily interest rate. This article provides a thorough description of how leveraged trading functions, which is thought to be quite dangerous.

Last but not least, FTX charges costs for leveraged tokens as well, including 0.10 percent creation and redemption fees as well as 0.03 percent daily administration fees for tokens like ADAHEDGE, which allows for a 1x short position on Cardano.

Users on FTX have the option of applying for a Visa-powered physical debit card. Debit cards that are linked to an account give users access to their available balance for spending. FTX will convert the other coins held in the account until the purchase price is matched if a user does not have enough USD on hand.

For its most experienced traders using its over-the-counter trading product, FTX provides a line of credit. If these users meet specific requirements, they may apply for a loan (which is not publicly disclosed and is subject to each individual application). The interest that FTX charges on those loans will then be used to finance its operations. The precise percentage is probably influenced by a trader’s supply of collateral, historical trading success, and other factors.

Services Offered thru FTX:

The FTX Crypto Exchange was created by traders for all users. Low costs for buying and selling popular items, including BTC, ETH, USDT, and FTT.

Awards & Recognition:

There is no data on it.

Competitors:

The top 10 FTX Alternatives & Competitors are –

- Square Point of Sale.

- Lightspeed Retail.

- Shopify POS.

- Heartland Retail.

- QuickBooks Point of Sale.

- LS Retail.

- Tessitura.

- Clover.

Latest News:

- Sam Bankman-Fried established the cryptocurrency exchange FTX in 2019 and served as its CEO up until this past Friday. By volume as of Tuesday, the exchange, which issues its own token called FTT, was the fourth-largest cryptocurrency exchange.

- Alameda Research, a cryptocurrency trading company that Bankman-Fried also started has a problematic balance sheet as of November 2, according to CoinDesk. According to the research, it has FTT is worth billions of dollars as its biggest asset.

- The CEO of competing exchange Binance, Changpeng Zhao, tweeted on Sunday that he intended to sell off Binance’s holdings of FTT because of “new disclosures that have come to light,” alluding to the CoinDesk article from November 2 about FTX and Alameda’s obscured funds. He likened the predicament of FTX to the crashes of TerraUSD and LUNA earlier this year, which destroyed the cryptocurrency industry and lost investors billions of dollars. However, such actions usually aren’t made public.

- Zhao’s revelation caused a sharp drop in the value of FTT during the following day as concerns developed that FTX lacked the liquidity required to support transactions and remain afloat. Other coins, like BTC and ETH, also saw a dip in value as Bitcoin hit a two-year low. In a tweet sent on Thursday, Bankman-Fried reported that $5 billion had been withdrawn from the site on Sunday.

- Zhao and Bankman-Fried negotiated an agreement for Binance to buy FTX’s international division. The CEOs of the exchanges agreed to a non-binding letter of intent on Tuesday, effectively pledging to save the failing exchange and avert a worsening market catastrophe.

- Binance pulled out of the transaction. Zhao tweeted the next day that Binance had finished its “corporate due diligence” and would not be purchasing FTX. Zhao said in a tweet that his choice was influenced by news stories about “mishandled customer monies” and “possible U.S. government probes.” In a mysterious tweet that ended with the words, “Well played; you won,” Bankman-Fried seemed to be alluding to Zhao’s impact on FTX’s decline.

- All withdrawals from non-fiat customers were stopped by FTX on Tuesday. FTX’s liquidity problems were explained in a series of tweets by Bankman-Fried, who also promised greater transparency.

- According to a recent article by The Wall Street Journal, Bankman-Fried informed investors that Alameda owed FTX roughly $10 billion for a loan that FTX provided to Alameda using customer deposits. However, the report states that FTX only had $16 billion in assets prior to the loan, which means that it lent out more than half of its assets.

- Trading “may be paused on FTX US in the next several days,” according to a Thursday notice issued on FTX.US’s website for users on the log-in screen. Users were instructed to close any positions they wished to, although withdrawals will remain open, according to the statement.

- The filing for Chapter 11 bankruptcy for FTX, FTX.US, and Alameda was made public by FTX on Friday. In contrast to Chapter 7 bankruptcy, which involves the liquidation of assets, Chapter 11 bankruptcy enables businesses to restructure their debt and carry on with operations.

- Despite earlier promises that FTX.US was unaffected by FTX’s liquidity issues, FTX.US likewise suspended withdrawals on Friday after the bankruptcy declaration.

- Both FTX and FTX In what appears to have been a hack, US wallets were stolen on Friday night. According to CoinDesk, more than $600 million was stolen from the wallets. On its help page on the messaging app Telegram, FTX announced the hack, writing, “A hack was made on FTX. FTX apps include viruses. Take them out. The chat window is open. Avoid visiting the FTX website as it could download Trojans.” Trojan horses are malware that poses as trustworthy programs.

- The same evening, FTX general counsel Ryne Miller announced on Twitter that due to the “unauthorized transactions” or the apparent breach, the business would swiftly move any remaining assets to cold storage, which is inactive.

Future Plans:

With the upcoming investment in MPL, FTX, which has a market cap of $32 billion, will formally enter the Indian startup scene, where it has hitherto primarily participated through partnerships and sponsorships.

The top two local cryptocurrency exchanges, CoinSwitch Kuber and CoinDCX are among the investments made by Coinbase, FTX’s rival, in Indian businesses to date. WazirX, which is owned by Binance, is in competition with the two Indian cryptocurrency exchanges.

Some FAQs:

Is FTX allowed in the USA?

There is a different exchange called FTX.US that is accessible, but US citizens are unable to utilize it due to stringent laws.

Can your FTX account go negative?

Despite having good total balances on FTX, some users have negative balances in a single coin, typically USD.

What led to FTX declaring bankruptcy?

FTX had $1 billion in yearly income by the end of 2021, but it struggled this year due to a sharp decline in cryptocurrency prices. After a string of errors and unsuccessful investments, FTX found itself billions of dollars in debt in a couple of weeks.

Why is the deal between Binance and FTX unraveling?

Binance said that it would no longer purchase FTX and stated that this decision was made “as a consequence of corporate due diligence.” Additionally, reports of misused funds and regulatory inquiries were raised.

Conclusion:

One of the biggest cryptocurrency exchanges in the world, FTX, has shut down, leaving a staggering $8 billion (£6.8 billion) hole in its balance sheet. Numerous of its 1 million consumers are currently unable to withdraw their money.

Hi, This is Scoopearth’s admin profile. Scoopearth is a well-known Digital Media Platform. We share Very Authentic and Meaningful information based on Real facts and Verification related to start-ups, technology, Digital Marketing, Business and Finance.

Note: You can reach us at support@scoopearth.com with any further queries.

Linkedin Page : https://www.linkedin.com/company/scoopearth-com/