India is progressing towards a cashless and digitalized era and is encouraging online modes of payment. The advancement of technologies and the rise of social media platforms have influenced today’s youth to a great extent. Nowadays, youngsters are quick in adapting to new inventions and shopping techniques due to online marketing applications. They are also becoming unpredictable, and it is getting challenging to cater to their increasing demands.

Today no one loves to ask for money from their parents before buying something. Whatever we wish to purchase is available online and gets delivered within 4-5 days. It is also possible because every person above 18 years of age has a bank account of their own. But what about those below the legal age? Do they still need to wait for their parents to hand over set pocket money to buy items of their choice? Well, the answer is no. family application comes to the rescue for the teenager’s wish list. So, let us find out more about the application as we read further.

What is Fampay?

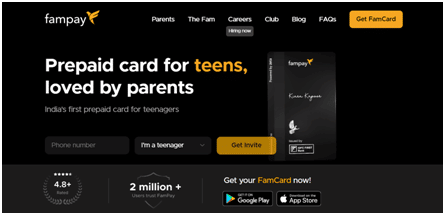

FamPay is India’s first payment application that came into existence in 2019. The application focuses on making teenagers financially independent and building saving habits. The Go Cashless campaign has paved the way for many indigenous payment and entertainment applications. All the existing applications have an age restriction of 18 years to access the payment facilities. So, the FamPay app focuses on the restricted age group ranging from 13-19 years, allowing them to experience the financial world.

The payment application gives the power to the parents to educate their children about the importance of money. It allows the parents to transfer the amount digitally into the FamPay account. The children can easily purchase any item with the same money and make payments through UPI and FamPay Card without any bank account setup. As the youngsters have their unique UPI ID, they experience the popular online payment method from a young age.

Fampay Founding Team Members ?

Now that we know about the FamPay, application let us meet the founding members behind its formation. Sambhav Jain and Kush Taneja are the IIT graduates who co-founded the startup company in 2019. During their college, both of them have worked for Rivigo, HotStar, and Share Chat. They also had connections with well-known global investors and venture capitalists. Notable contributors include Kunal Shah (CRED), Amrish Rau (Pine Labs), Neeraj Arora (ex-Whatsapp), and Kevin Lin (Twitch). The team of 40 members aims to create an in-app marketplace for GenZ teenagers and their families.

How does Fampay Work ?

FamPay is the best way to teach the youngsters about personal financing and making correct saving decisions. The app also eliminates the need to steal and the risk of giving bank credit cards to children. The company has a strong team that prioritizes the user’s demand and works hard for its execution. It has a certified license from the Reserve Bank of India and is partners with RuPay and IDFC First bank. It also emphasizes completing the KYC verification process for both the parents and their children. Users can download the application from App Store and Google Play Store and start using it after mobile number verification.

FamPay has worked with the National Payments Corporation of India (NPCI) to launch India’s first numberless card. The card is known as FamCard and has similar functions as any debit card. The unique feature of the card is that it does not have credentials like CVV and expiry date printed on it. Users can deposit a maximum of INR 10,000/- per month in the FamPay Account. They can also have a zero-balance account and track the expenses details through the FamPool feature. To date, the company has more than 1Lakh+ registered users that have developed the habit of going cashless.

Fampay Services and Facilities?

In the USA, children below 18 years work part-time and earn allowances. But it is not the same in India as minors are not allowed to work according to the child labor law. So FamPay application is a medium for the parents to provide financial literacy to their children. The application does not charge any hidden fees when the account is paused and has a zero balance. Parents can also set the spending limit, control the payments, lock the device, and block the card anytime.

The application also has a social feed where the children can share their spending receipts through gamification. They can also receive cash back and double their savings after achieving a particular saving limit. More than 50000+ parents love the purpose behind the launch of the application. Users can also shop for brands, order food or groceries, recharge prepaid mobile phones, and top-up in-game currencies through CodaShop. The company also takes good care of its employees and provides them the best resources. Facilities include top gadgets, hygienic meals, gym memberships, health insurance policies, and flexible working hours.

Fampay Current Job Offerings ?

FamPay is focusing on making the 250 million+ Indian teenagers financially independent and going cashless. It also assists the parents in helping their children understand the fundamentals of saving money. The company is also hiring employees for different posts like Product Designer, Graphic Designer, Video Editor, Brand Designer, UX Researcher, and 3D Designer. It also has openings for iOS Engineer, Backend Engineer, Frontend Engineer, Android Engineer, Product Marketer, Growth Associate, and Site Reliability Engineer. You can also apply for posts like Finance Controller, Data Analyst, Public Relations, Human Resource Head, Talent Acquisition Tech, and Customer Love Escalations.

Safety and Security:

You must be wondering if it is safe to allow underage children to access financial services. The answer is yes. FamPay application is a secure and reliable app as it follows the regulations set by the Reserve Bank of India. The application allows the users to register the mobile numbers with the One Time Password (OTP). It also insists both the children and their parents complete their Know Your Customers (KYC) procedure. It collects and saves personal information like Name, Email ID, Date of Birth, Residential Address, PAN, and Monthly Income. FamPay app allows locking their device through PIN, Face ID, Fingerprint, and Pattern Lock.

FamPay is working with IDFC First Bank to provide prepaid and numberless cards to teenagers. You can use this FamPay card online or offline and can also block or pause anytime. It also has a Flash PIN feature that allows the shopkeeper to see the card pin while billing payment. The FamCard is a numberless card, so there is no risk of being stolen or lost, and the PIN gets disclosed. You are also free to set the daily/weekly/monthly spending limit and stop any transaction anytime. The company has strict rules and takes severe actions if anyone illegally uses the FamPay Card.

About Fampay Club:

FamPay Club is a community that focuses on teaching children how to earn, learn new skills, and expand their knowledge. FamPay believes that the youth is the future, so precise guidance about the changing world is essential. The Gen Z forum allows the children to communicate and interact with new friends all over India. It also helps them know about the different lifestyles, cultures, and traditions of the people around them. Community engagement changes the mind and perspectives of the children encouraging them to think out of the box. The Game Zone and Happy Inc section is a one-stop destination filled with fun and excitement. Here the users can play games, chat with friends, and read about mental health.

The FamPay Academy is a platform designed to enrich, empower, and enlighten young minds. It offers a master class on unique subjects with industry experts and seeks scholarships in premium institutes. The students can also read blogs on The Unread platform and receive professional career counseling. FamCoins are digital currency that users can earn from offers, rewards, discounts, and various premium services. Children can also take part in quizzes through the Quizzader section and win prizes from the Discord Gaming Events. Through the Teenfluencer Program, the children can access handcrafted marketing boot camps and become one of the Friends of Fam forums.

Conclusion:

The FamPay application is a perfect app designed for increasing the creativity and financial awareness of every youngster. Through the application, children below 18 years of age can have a flavor of independence and gain new experiences about life. The application is safe to use and functions according to the child’s parents. Parents can also analyze the needs and interests of their kids through constant monitoring and activity tracking. Activities like bot-games, giveaways, karaoke, slam-poetry, and recipe making are its new additions. So, without any further ado, go ahead and download the FamPay App now.