Monday, 19 February 2024, Bengaluru, India

Former Coinbase employee Stephanie Song was frequently irritated by the amount of daily due diligence activities she and her team had to finish. Stephanie Song worked in the corporate development and ventures department.

(Image Source: Techcrunch.com)

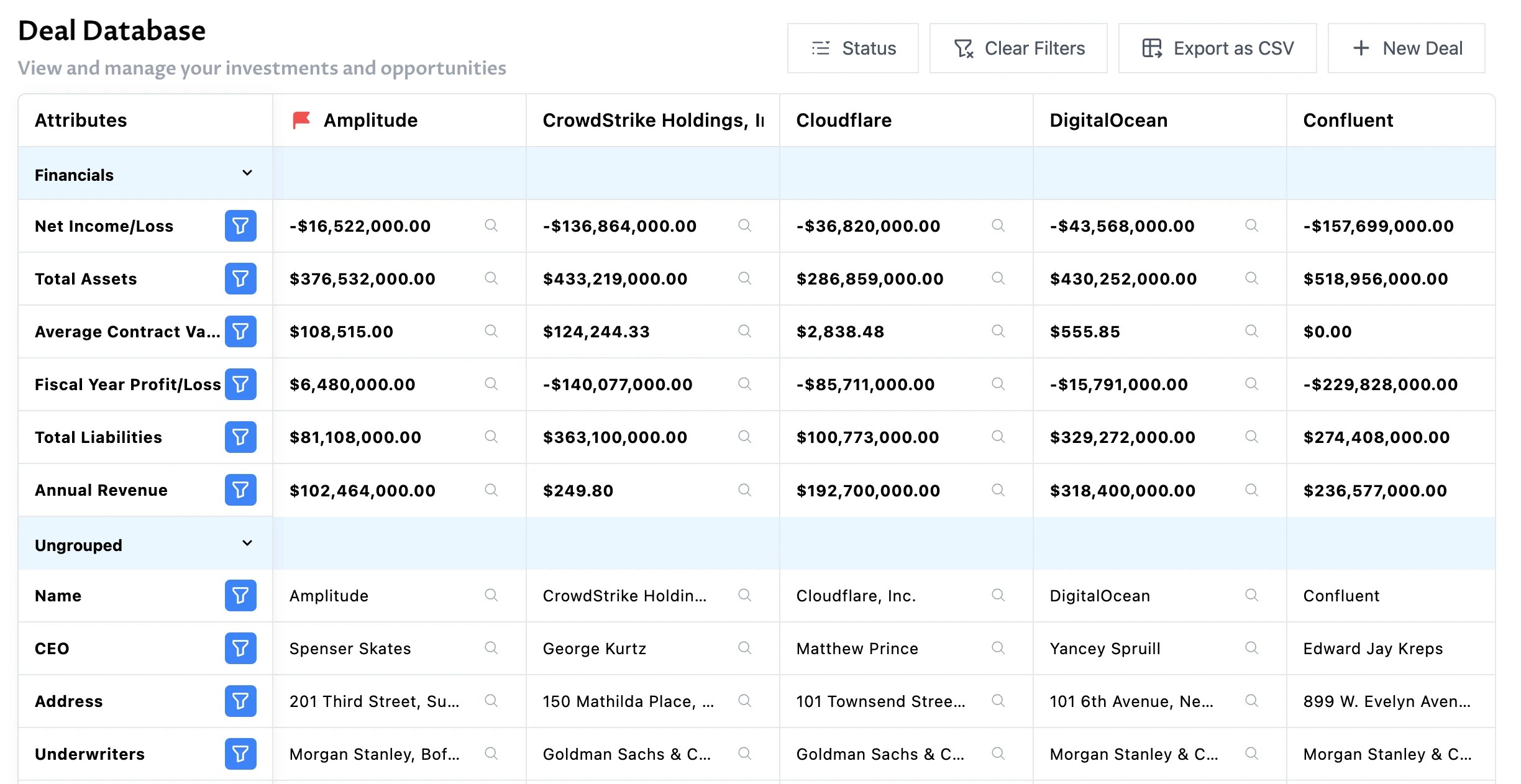

Motivated to discover an improved approach, Song joined forces with two former coworkers from Coinbase, Brian Fernandez and Anand Chaturvedi, to introduce Dili (not to be confused with the capital of East Timor), a platform that uses artificial intelligence to try and automate necessary steps in portfolio management and investment due diligence for private equity and venture capital firms.

As of right now, Dili, a recent Y Combinator alumna, has secured a total of $3.6 million in venture capital from investors such as Rebel Fund, Singularity Capital, NVO Capital, Amino Capital, Hi2 Ventures, Gaingels, and Hyper Ventures.

According to Song, “[AI] affects every aspect of an investment fund, including partners, analysts, and back-office operations.” Funds’ investment experts are seeking a unique advantage in their decision-making, and they can now leverage their abundance of data to blend their comprehension of the deal with how it fits into the funds. Dili has a unique chance to become known as a financial hub in a challenging macro climate.

Regarding funds seeking an advantage or any fresh, promising means of reducing investment risk, Song is not incorrect. As they became more wary of early-stage enterprises, venture capitalists (VCs) raised the least amount of money ($67 billion) in seven years last year, according to reports that they have $311 billion in unspent funds.

AI should be used in the due diligence process more than just by Dili. According to Gartner, artificial intelligence (AI) and data analytics will be used to inform over 75% of VC and early-stage investor executive assessments by 2025.

AI is already being used by several startups and established companies to sift through financial records and vast volumes of data to create market comparisons and reports. These companies include Wokelo (whose clients are VC and private equity firms, such as Dili’s), Ansarada, AlphaSense, and Thomson Reuters (via its Clear Adverse Media division).

Dili uses GenAI to expedite investor operations, notably massive language models similar to OpenAI’s ChatGPT.

To automate tasks like parsing databases of private company data, handling due diligence request lists, and searching the web for little-known figures, the platform first catalogs a fund’s historical financial data and investment decisions in a knowledge base.

Recently, Dili implemented functionality for industry benchmarking and automatic comparable analysis based on a company’s deal backlog. Funds can compare past and present investment opportunities in one location once they upload their deal data.

After all, AI isn’t always renowned for adhering to the truth. When ChatGPT was evaluated to see how well it could summarize articles, Fast Company discovered that the model frequently made mistakes, omitted essential elements, or outright made up information that needed to be in the articles it summarized. It’s easy to see how this could materialize into a severe issue of due diligence tasks, where precision is crucial.

Prejudices may also enter the decision-making process through AI. An algorithm trained to recommend startup investments was found to favor investing in companies with male founders and to favor white entrepreneurs over entrepreneurs of color in an experiment by the Harvard Business Review a few years ago. This is because fewer women and founders from underrepresented groups typically need more support during the funding process, which eventually results in lower venture capital. This is reflected in the public data that the algorithm was trained on.

Furthermore, some businesses might feel uneasy using a third-party approach to handle their sensitive, private data.

According to a Bloomberg Law survey, 30% of deal lawyers stated they wouldn’t contemplate utilizing artificial intelligence (AI) as it stands now at any point during the due diligence process. They gave as their reason the possibility of breaking deal confidentiality agreements by inputting third-party data into AI software.

To soothe all of those worries, Song stated that Dili is still improving the models, many of which are open-source, to lower the number of hallucinations and boost overall accuracy. She further emphasized that Dili does not use private customer data for model training and that Dili intends to provide funds with an option to build their models using offline, proprietary fund data.

Four hundred users and analysts from various banks and fund kinds participated in Dili’s first pilot program, which was conducted last year. However, Song notes that as the business grows its staff and acquires new skills, it hopes to branch out into other markets and eventually develop into an “end-to-end” solution for portfolio management and investor due diligence with AI.

(Information Source: Techcrunch.com)

Hi, I am Subhranil Ghosh. I enjoy expressing my feelings and thoughts through writing, particularly on trending topics and startup-related articles. My passion for these subjects allows me to connect with others and share valuable insights.