Introduction:

A credit score rating is a numerical expression primarily based totally on a stage evaluation of a person’s credit score files, to symbolize the creditworthiness of an character. A credit score rating is based totally on a credit score report, facts commonly sourced from credit score bureaus.

Your credit score rating could have a huge effect for your economic future, whether or not it is shopping for a house, renting an condominium or touchdown your dream job. Join over 1,000,000 Canadians and get the gear you want to assist apprehend, control and grasp your credit score – in beneathneath three mins.

Borrowell is a fintech employer that gives credit score rating tracking, invoice monitoring and economic advisory offerings for individuals. Borrowell Inc. offers financing for customer loans. The Company gives equipment, customer and industrial revolving credit score, and scholar loans. Borrowell serves clients in Canada.

Ok so lets today discus about the start up story of Borrowell along with the founder, CEO, Borrowell history and Borrowell competitors.

About:

Borrowell is a Canadian-primarily based totally Financial Technology (FinTech) employer that features as a economic product and offerings market. Borrowell offers loose credit score tracking and extra than 850,000 Canadians have acquired their loose credit score rating via Borrowell.

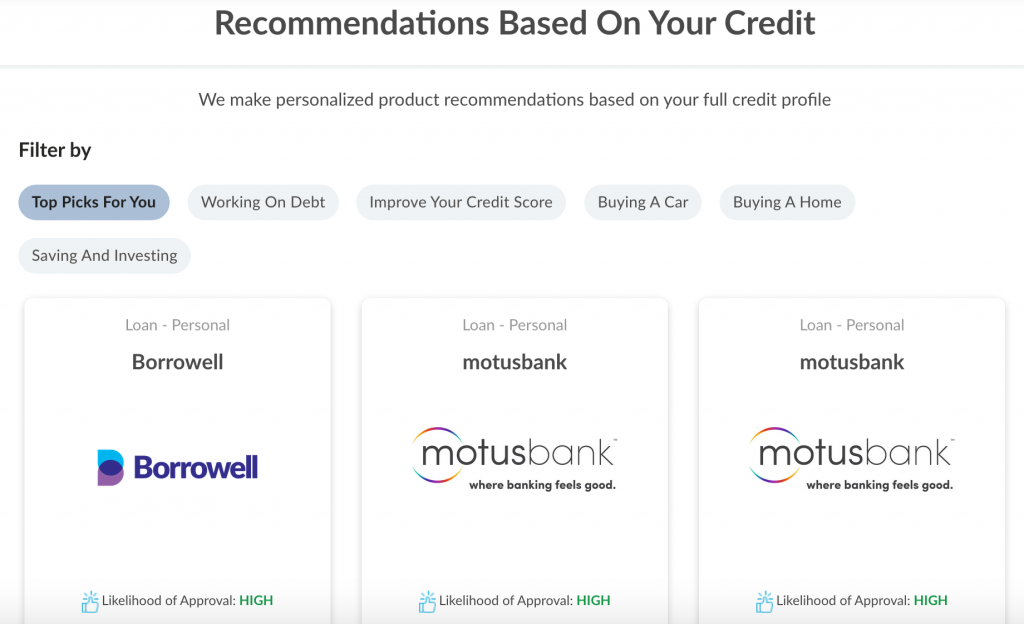

The employer makes personalised economic product guidelines primarily based totally on participants’ credit score facts to assist clients enhance their credit score rating and economic well-being.

These guidelines encompass non-public loans, mortgages, credit score cards, and different economic merchandise tailor-made to the precise dreams and credit score profile of every consumer.

Borrowell earns a referral price on loans and economic merchandise it does now no longer difficulty itself. Borrowell currently launched “Credit Coach” to similarly assist participants enhance their participants’ credit score health.

Canadians have a debt problem, absolute confidence approximately it, however they probable owe extra than they should, given the hobby costs of 20% or extra that they pay on their credit score cards. Canadian families owed $1.nine trillion in non-public debt as of January this 12 months, an growth of $94.2 billion from a 12 months earlier, in line with RBC.

Credit-card debt changed into $seventy seven billion of that general and up three.5% over the equal period. The common credit score card changed into carrying $three,810 on the cease of 2015, up 4.1% from 2014, in line with TransUnion.

With customer debt at report levels, Borrowell has located extensive call for for its merchandise, which empower clients to enhance their economic well-being. More than three hundred,000 Canadians have a Borrowell account, with hundreds extra signing up every week.

Borrowell Founder & Team:

- Andrew Graham: Co-Founder and CEO (2014-Present).

- Eva Wong: Co-Founder and COO (2014-Present).

- Jeff Yim: VP, Finance (2017-present).

- Larissa Holmes: VP, Talent (2017-present).

Borrowell History:

Now lets discuss about Borrowell history.

Borrowell changed into based in 2014 with the aid of using Andrew Graham. Andrew had formerly labored at PC Financial, every other opportunity economic institution. While at PC, Andrew and his companions observed an possibility withinside the marketplace to assist customers refinance their debt at extra conceivable levels.

In 2014, Borrowell acquired the vital seed investment to release and has been capable of offer low-hobby loans to hundreds of Canadians. As of 2019, Borrowell has over 850,000 participants.

- February 22, 2021: Borrowell increases $25 million to fund acquisition of Refresh Financial.

- June 18, 2019: Borrowell increases a $20,000,000 collection B spherical from White Star Capital.

- June 17, 2019: Borrowell closes $20 million Series B such as fairness and mission debt, co-led with the aid of using White Star Capital and Portag3 Ventures. Other contributors withinside the spherical encompass Clocktower Ventures, Argo Ventures, Silicon Valley Bank, and LGBT affinity funding institution Gaingels. The Series B spherical brings the employer’s general raised in fairness to $36.7 million.

- July 21, 2017: Borrowell increases a $nine,500,000 collection A spherical from Portag3 Ventures.

- 2014: Borrowell changed into based.

Borrowell Revenue:

- Borrowell’s predicted annual sales is currently $16.8M in line with 12 months.

- Borrowell’s predicted sales in line with worker is $130,000

- Borrowell’s general investment is $92M.

- Borrowell has 129 Employees.

- Borrowell grew their worker be counted number with the aid of using 79% final 12 months.

Funding & Investors:

Financial era employer Borrowell introduced nowadays it has secured $12 million (CAD) in fairness investment and $forty five million in new credit score centers. The Series A fairness spherical is being led with the aid of using Portag3 Ventures LP, Equitable Bank and White Star Capital, with participation with the aid of using FirstOntario Credit Union and different new and current investors, and brings the employer’s general fairness financing to $16.7 million.

The credit score centers are being supplied with the aid of using Concentra and FirstOntario Credit Union for the cause of investment ‘one click on’ loans to high consumers. This ultra-modern spherical of investment will permit Borrowell to offer loose credit score facts and loans to extra people.

- Borrowell has raised a complete of $92M in investment over 7 rounds. Their ultra-modern investment changed into raised on Feb 22, 2021 from a Series C spherical.

- Borrowell is funded with the aid of using 25 investors. Business Development Bank of Canada and Kensington Capital Partners Limited are the maximum latest investors.

- Borrowell has received Refresh Financial on Dec 15, 2020.

Borrowell Revenue Model:

There isn’t anyt any records of it.

Borrowell Startup Overview:

Lets check the Borrowell overview which is details of Borrowell –

| Company Name | Borrowell |

| Parent Company Name | -Refresh Financial Inc. |

| Website Url | https://borrowell.com/ |

| Owner | Andrew Graham |

| Address | Toronto, Ontario, Canada |

| Headquarters | Toronto |

| Industry | -FinTech |

| Competitors | -Invoiced, Tesorio, Quadient Accounts Receivable Automation by YayPay, HighRadius, Versapay. |

| Total No. of Employees | 129 |

| Founder | Andrew Graham |

| Funding | – $92M |

| Founded Year | 2014 |

| Valuation | -$1.73 Billion Valuation |

| Total Funding | $92 M |

| Revenue | $16.8 M |

| Contact | media@borrowell.com |

| Country | -Canada |

| Launched By | -2014 |

| Contact No. | -+1 416 800 0950 |

Services Offered thru Borrowell:

- Free Credit Monitoring – Sign up in only three mins totally free get right of entry to on your Equifax credit score rating and report, which we replace each unmarried week.

- Credit Education – The first in Canada, our AI-powered Credit Coach enables you apprehend your credit score rating and offers suggestions that can enhance it.

- Product Recommendations – Compare economic merchandise from over 50+ companions and get personalised guidelines primarily based totally for your credit score profile.

- Track Your Bills and Your Credit Score For Free – Monitoring your credit score rating is important, and that is why we replace it for our participants each week. But now you may screen your credit score rating AND tune your payments multi functional region with the Borrowell cellular app. Stay prepared and by no means omit a invoice payment.

Borrowell Awards & Recognition:

Borrowell has been identified in severa awards, such as Globe and Mail’s Top Growing Companies, LinkedIn’s Top Startups in Canada

Borrowell Competitors:

Talking about Borrowell competitors top Alternatives & Competitors to Borrowell are –

- Invoiced.

- Tesorio.

- YayPay with the aid of using Quadient.

- HighRadius.

- Versapay.

- Lockstep.

- You Need A Budget.

- Bilendo.

Borrowell Latest News:

- May 2, 2022: Globe Newswire — Equifax® Canada Launches Final Stage of Cloud Transformation with Borrowell

- Nov nine, 2021: BetaKit — Borrowell co-founder secures seed capital for Savvyy to address banking facet of virtual lending

- Jul 15, 2021: Crowdfund Insider — Consumers Need to Avoid Revenge Spending Post-Pandemic: Borrowell

Borrowell Future Plans:

Borrowell has already proven its capacity to assist its numerous consumer base enhance credit score ratings via credit score transparency, training and get right of entry to to economic merchandise.

We invested withinside the employer with a perception that the purchase and enlargement of proprietary merchandise will permit even more economic mobility for its clients with the aid of using imparting a broader suite of services and products that meet the numerous desires of every user.

Some FAQs About Borrowell :

Can I believe Borrowell credit score rating?

Borrowell is simply as stable as your conventional financial institution because they use comparable era to shield your non-public details.

Is Borrowell a great employer?

Borrowell is one of the exceptional on line creditors to be had in Canada, proved with the aid of using the numerous Borrowell reviews.

So, in case you need a pinnacle non-public mortgage from an approved lender and a loose credit score rating, Borrowell is an splendid choice.

What is Borrowell?

Borrowell is a Canadian-primarily based totally fintech employer that features as a market platform for on line lending.

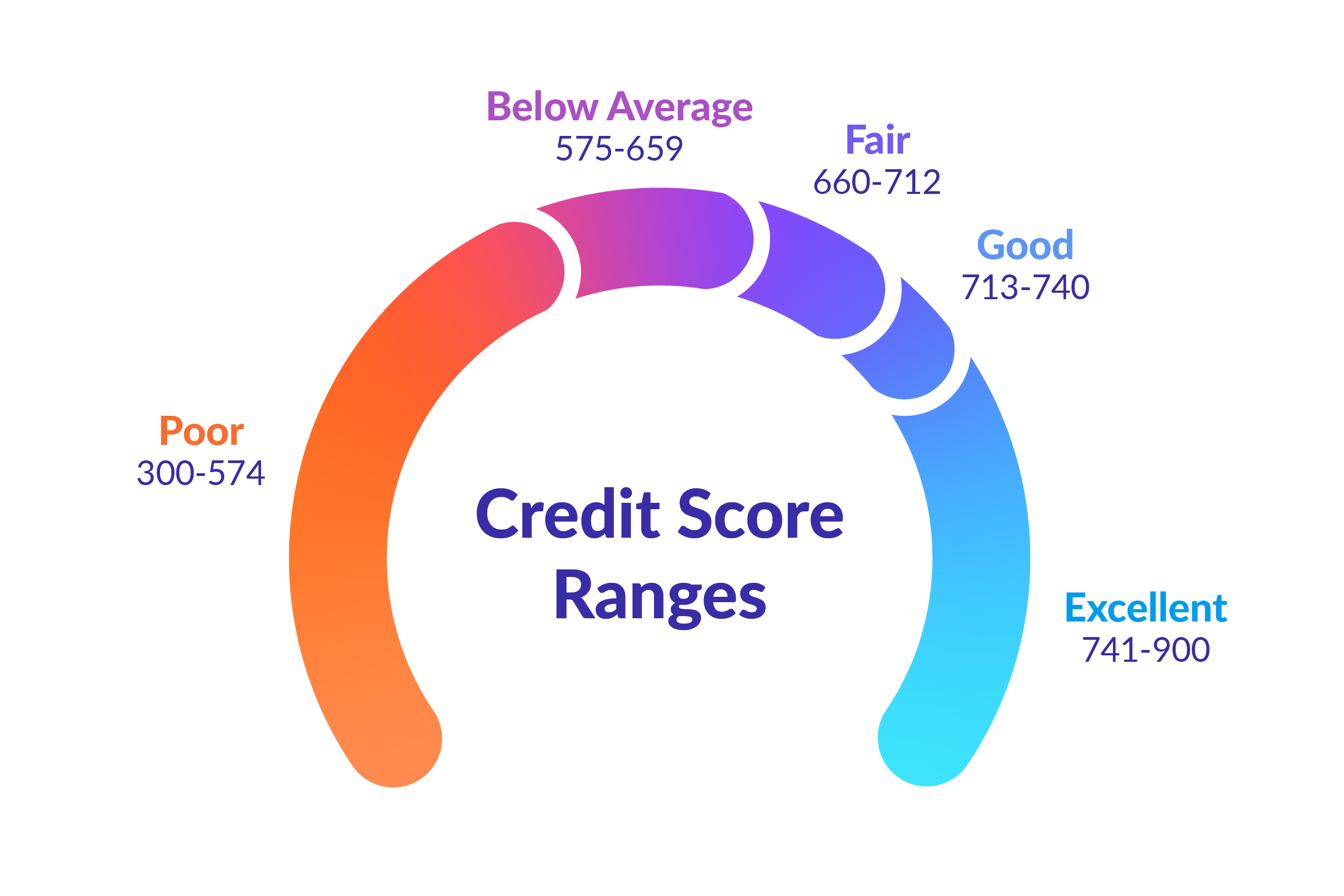

What is the very best credit score rating in Canada?

In Canada, your credit score rating tiers from three hundred to 900, 900 being an ideal rating. If you’ve got got a rating among 780 and 900, this is splendid.

How does Borrowell make money?

Our enterprise generates sales with the aid of using recommending merchandise including loans, financial savings accounts, and different economic merchandise primarily based totally for your precise credit score profile and economic dreams.

If you’re taking a product we recommend, that companion can pay us a referral price.

How correct is Borrowell Canada?

Borrowell is one of these offerings and one in all Canada’s maximum depended on at that. Below, you will locate an outline of Borrowell.

Borrowell shows your credit score rating totally free and shows a rating at once from Equifax, the usage of the Equifax RiskScore 2.zero rating model.

Where is Borrowell primarily based totally?

Toronto

Conclusion:

The Financial consumer Protection Agency of Canada functions a manual this is useful greater facts concerning the risks of pay day loans and possible options, such as credit score counselling (click on the hyperlink to analyze extra).

Borrowell is teaching Canadians on true character finance practices and marketing and marketing economic obligation. Sustainable financing is essential to the enterprise enterprise and ethos model.

Hi, This is Scoopearth’s admin profile. Scoopearth is a well-known Digital Media Platform. We share Very Authentic and Meaningful information based on Real facts and Verification related to start-ups, technology, Digital Marketing, Business and Finance.

Note: You can reach us at support@scoopearth.com with any further queries.

Linkedin Page : https://www.linkedin.com/company/scoopearth-com/