Friday, 23 August 2024, Bengaluru, India

Home fitness equipment and subscription-based firm Peloton Interactive recorded year-on-year quarterly revenues for the first time in over two fiscal years. Peloton reported revenue of $643.6 million, and the first quarter note also indicates an improvement in the unemployment rate by 0.2% higher compared to the same period of the previous year in its fiscal fourth quarter. The subscription revenue also showed a positive movement; it increased by 2.3% to $431.4 million.

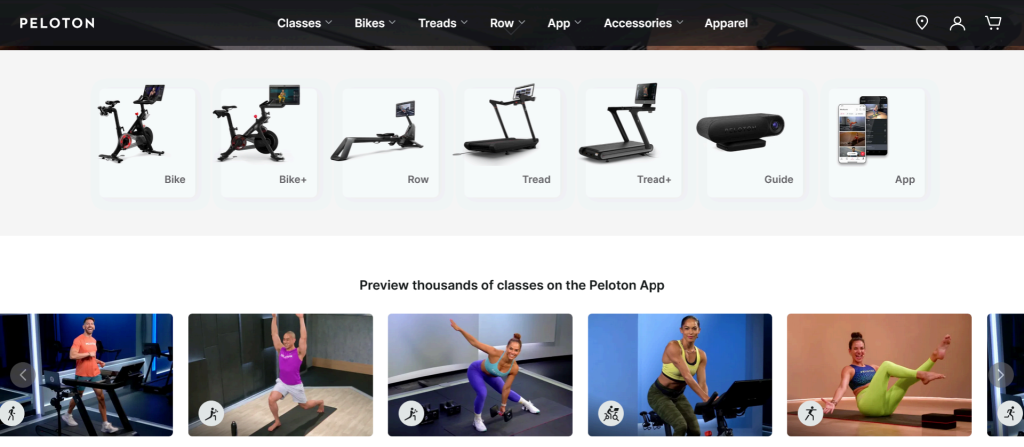

Image Source: Peloton

Financial Narrower Losses of Peloton

Relative to the financial metrics, Peloton also appeared to improve managing costs. The company posted a slightly better loss than what was anticipated by analysts of $30.5 million (8 cents per share) compared to $241.8 million (68 cents per share) of the prior year. Thus, Peloton attributed this improvement to its constant striving for cost-realization against business scale and the company’s attempt to provide a restructuring plan that sought over $200 million of cost.

Peloton’s Restructuring Plan

Peloton has recently moved from the growth strategy to the profit strategy. The strategies include focusing on achieving free cash flow and returning to admiring profitability. The cost-saving plan among the restructuring plan entails downsizing global employees by 15% with the target of achieving $200 million in annualized cost savings by the end of the fiscal year ending in 2025.

Peloton has reported year-on-year revenue growth for the first time since Q4, FY19, with sales increasing by 0.2%. The company remarkably decreased the size of the loss to $30.5 million (8 cents per share) compared to $241.8 million (68 cents per share) in the same period of last year. Peloton provided for adjusted EBITDA and free cash flow for the second successive quarter a trend that was traced since the peak of covid-19 crisis.

Earlier in the week, Peloton unveiled a refinancing plan that involves global changes to its current term loan and revolving credit facility. The fitness retailers also intend to offer new convertible notes to help reduce the portion of 2026‘s maturing debts. The restructuring plan implies that performance is set to improve to higher levels of financial health and profitability and stable growth aspects for the firm.

Future Prospect

The outlook for fiscal 2025 has been a cause for concern as its revenue expectation is projected to be between $2.4 billion and $2.5 billion compared to 6,474 in fiscal 2024, which had declined by 9%. The cautious financial approach remains the key to the company’s development, and the process of the new CEO search begins. People interested in its financials and those in the fitness industry focused on innovations will be especially keen on its further steps during this stage.

Conclusion

Many of Peloton’s investors have decided to reinvest their earnings due to the unexpected record revenues seen over the past year. This is good news for the company, but how it will continue to maintain this kind of pace and deliver on its operational and structural cost-saving strategies will define its longevity.