Introduction:

Slice (formerly known as SlicePay) is a company that operates a digital credit platform. Its product’s target audience is students and graduates. The company gives its client access to products and services, allowing them to pay over time.

Company Profile:

| Company Name | Slice |

| Headquarter | Bengaluru, India |

| Industry | Finance |

| Founded | 2016 |

| Founder | Deepak Malhotra, Rajan Bajaj |

| Website | https://www.sliceit.com/ |

Slice About:

Slice (Image Source: telanganatoday.com)

Slice provides physical and virtual financial cards and digital financing services for students. It enables students and salaried professionals to buy collateral-free products and services online on easy monthly installments (EMI) through an application and helps them in building credit scores.

It was formerly known as Slice Pay. The company was founded in 2016 and is based in Bengaluru, India. It aims to serve Gen Z and millennial audiences the ones which are less desired by the Conventional banking business.

Industry:

Slice is the developer of consumer payment software designed to facilitate a multipurpose payment application for all spending needs.

The company’s platform offers credits to salaried-premium and non-premium and student segments on monthly payment plans without any collateral, enabling students and salaried professionals to buy products and services online on EMI through an application and help them in building credit scores.

Founder & Team:

Slice Founders (Image Source: growwithmarkets.in)

Deepak Malhotra and Rajan Bajaj founded the Slice company in 2016. Its headquarter is in Bengaluru, India. it has 12 members strong credit risk team that includes Data Analysts and Business Analysts and they are responsible for building the risk models and reporting. The risk team works closely with the Data Engineering and Technology team.

The data engineering team consists of 2 members and their primary responsibility is to prepare data and make it available for the risk team. Meet Vivek who works as a Data Engineering Lead at Slice and he is responsible for creating & maintaining data pipelines and making the analytics-ready data available to the risk, product, business, growth, finance, and marketing teams for reporting.

Startup Story:

Bengaluru-based fintech startup Slice was started six years ago by Rajan Bajaj. Rajan started his entrepreneurial journey in his early 20s with Mesh Internet in 2015. He later founded slice in 2016 to ease the financial anxiety that new-age customers go through when it comes to payments and credit. Slice is essentially a prepaid card, which comes with a credit line. It was formerly known as SlicePay, and Hello Buddy.

Speaking about the turning point in his career, Rajan says, while he was at IIT Kharagpur, he developed a passion for startups. He recalls that he looked up to Airbnb so much that he thought of dropping out in the second year of engineering and starting a company in the shared economy space in India.

However, after completing his graduation, Rajan landed a job at Flipkart, where he was part of the product team and worked on payments. After about 10-11 months into it, he had an urge to work on his shared economy idea. Soon, he shut down the company and started Slicepay, now slice, as a ‘buy now pay later’ (BNPL) platform, but the initial three years were a struggle.

Mission & Vision:

The aim of the company is to build an ecosystem for the youth that solves all their financial needs and make their lives epic.

Name & Logo:

Slice Logo (Image Source: sliceit.com)

Business Model:

The company and its 29-year-old founder boast of their understanding of their target audience the millennials and Gen-Z this age group is in the initial stage of their careers due to which traditional Banks never prioritize servicing them hence the Service that Slice is tailor-made for them.

This is how the slice operates, salary slips and bank statements are not needed to get a slice card a lack of steady income or a low civil score doesn’t matter either. This card is free for life No joining or annual fee, It’s users can pay back the amount in 3 months without any charges instead of the conventional one month, It’s cards have the most flexible credit range to choose from just Rs 2 thousand and extending up to 10 lakhs, every transaction is rewarded with 2% cashback.

The best feature which is considered of Slice is low-Cost EMI. It gained National and International attention in October when it introduced a revolutionary three-day workweek in India. They say their employees pursue other endeavors in life too the company is tight-lipped about the numbers.

Revenue Model:

- Interest on Credit:

- Slice generates revenue by charging interest on outstanding credit balances. If users fail to pay off their dues within the interest-free period, Slice charges an interest rate on the remaining balance.

- Merchant Partnerships:

- Slice partners with various merchants and retailers, offering discounts or cashbacks to users when they make purchases with the Slice card. In return, Slice earns a commission from these merchants for every transaction made by users.

- Annual Fees and Subscription:

- Slice might also generate revenue through annual membership fees or subscription plans for premium features or exclusive benefits available to users who opt for paid plans.

- Late Payment Charges:

- Like traditional credit card issuers, Slice also earns revenue from late payment fees if users miss their payment deadlines.

- Interchange Fees:

- Slice earns revenue through interchange fees, which are charges merchants pay to process credit card transactions. A portion of this fee is shared with Slice.

- Partnerships and Collaborations:

- The company may enter into strategic partnerships or corporate collaborations with other financial institutions, fintech startups, or brands, generating additional income through joint ventures or co-branded campaigns.

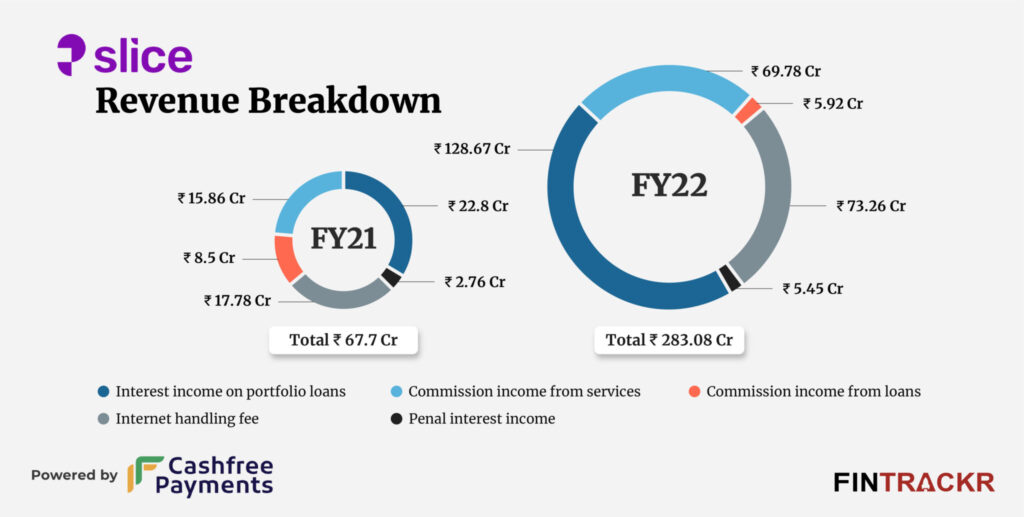

Slice Revenue (Image Source: entrackr.com)

Products & Services:

It provides a credit-based payment solution designed & customized exclusively for young professionals, gig workers, freelancers, startup employees, and graduates. All applications are accepted on the slice app available on Google Play and App Store.

The company uses its proprietary credit rating system built using data science algorithms to find out the creditworthiness of each customer. The algorithm uses data coming from their mobile application and checks over 50 parameters to find out the credit score.

Funding & Investors:

- It has raised $353.73M over 18 rounds.

- It’s latest funding round was a Series C for $50M on June 1, 2022.

- It’s valuation in November 2021 was $1,000M.

- Slice’s latest post-money valuation is from June 2022.

- Slice’s deal structure is available for 4 funding rounds, including their Series C from June 01, 2022.

- It has 33 investors. Moore Strategic Ventures invested in Slice’s Series C funding round.

- It acquired 1 company. Their latest acquisition was Trustio on February 02, 2017.

- Slice raised 220 million Dollars in its series B which took beyond the billion Valuation mark interestingly the company was valued at 200 million some months back but soaring in popularity in recent months has made it grow by 5x times.

Employees:

It has 500 employees.

Challenges Faced:

Three years into it, Rajan says, he was not trusted by the banks and creditors, and understanding regulation, understanding the business, and operations became challenging.

At Slice, all their mobile application data gets stored in the MongoDB database and they use Amazon Redshift as their single source of truth. A year back there was no data engineering team at Slice, the technology team used to manually write the custom Python scripts to migrate their MongoDB data to Redshift, and it used to take almost 3 days to build a single data pipeline.

As the data grew, they realized the need to adopt an automated data integration solution, primarily for these 3 reasons:

- Manually writing Python scripts was time-consuming.

- Reading Changelog Steam and maintaining the custom code was challenging.

- Building the in-house data infrastructure was a complex and costly affair.

Acquisitions:

- Slice has made 2 acquisitions. Slice has invested in multiple sectors such as Business Intelligence and more.

- It has acquired a 5% stake in the Indian bank North East Small Finance in what analysts say is a key step in the unicorn fintech startup’s journey amid mounting challenges from the central bank that has toppled many young firms.

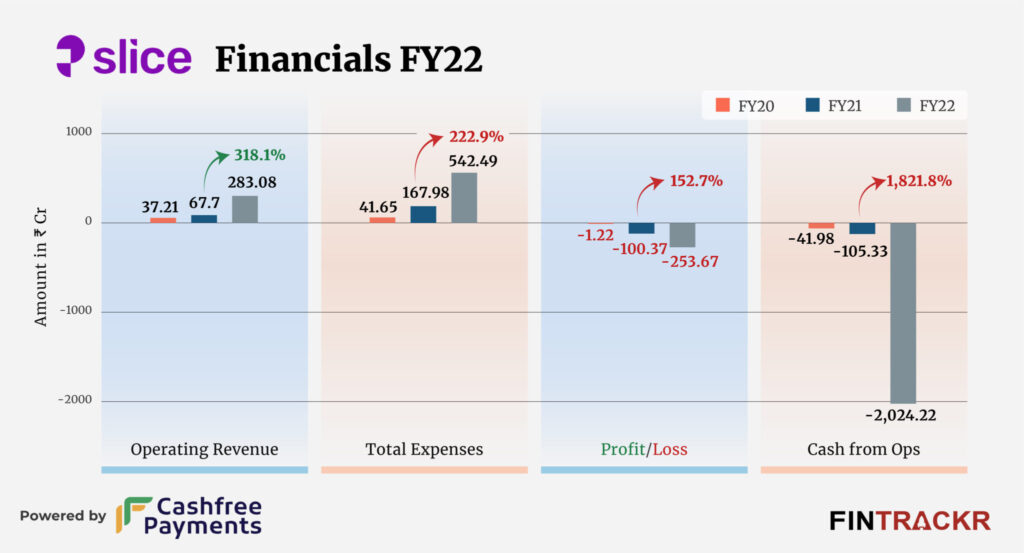

Slice Growth (Image Source: entrackr.com)

Growth:

It aims at expanding its offerings to over 50 cities in India and reaching the 1 million customer milestone in 2021. Hevo is happy to be a part of Slice’s growth journey and looks forward to strengthening this partnership in years to come.

Partners:

The startup has now grown to 600 people and is backed by leading VCs such as Gunosy Capital, Das Capital, Finup, Simile Venture Partner, EMVC, Blume Ventures India, Tracxn Labs, Better Capital, Sachin Bansal’s Navi, alongside angel investors such as Kunal Shah.

Competitors:

Major competitors for Slice include:

- OneCard.

- Uni.

- Stashfin.

- CheQ.

- KrazyBee.

- CRED.

Awards & Achievements:

There is nothing related to it.

Future Plan:

Slice looks forward to having around 150 million users who would opt for credit cards or BNPL products over the next 5-7 years. Furthermore, the unicorn credit startup also aims to extend its presence to over 24 cities by the end of 2022, most of which would be in Tier 2 and Tier 3 cities.

FAQs :

What does Slice do?

It is a leading fintech company focused on India’s youth. They aim to build a smart, innovative, and transparent platform to redesign the financial experience for millennials and GenZ.

When was Slice founded?

It was founded in 2016.

Who is the founder of Slice Corporation?

Deepak Malhotra and Rajan Bajaj founded the Slice company.

Who is the CEO of Slice Corporation?

Rajan Bajaj is the CEO.

Who are the main competitors of Slice?

Major competitors for Slice include:

- OneCard.

- Uni.

- Stashfin.

- CheQ.

- KrazyBee.

- CRED.

What is required for a slice?

You will have to maintain a Cibil Score of 750 and above to get a credit card easily. If you don’t have such a credit score then you can apply for the Slice Super Credit Card that only needs a minimum age of 18 years.

What are the disadvantages of a slice?

While there is no cost EMI facility on this card, many customers complain that EMI interest is charged. Some customers complain that there is a problem while repaying the payment on the Slice app. Slice Company does not easily increase the credit limit on this card.

Conclusion:

It is India’s leading payment and credit start-up. Founded in 2016, the slice is building financial products and services to meet the unmet financial needs of Gen Z and Millennials across the country. Their flagship product, the slice card, is an alternative to traditional credit cards.

It comes with a pay-later line and is issued in partnership with Visa. With 280k+ members and a 700k+ strong waitlist, today slice is a market leader and has emerged as a preferred card of choice for the young generation.

Sai Sandhya is Known for her expertise in Trending News and Startup News. She is passionate about bringing Startup Stories to life. Her proficiency in curating Listings and analyzing Case Studies adds exceptional value to the ever-evolving Business landscape.