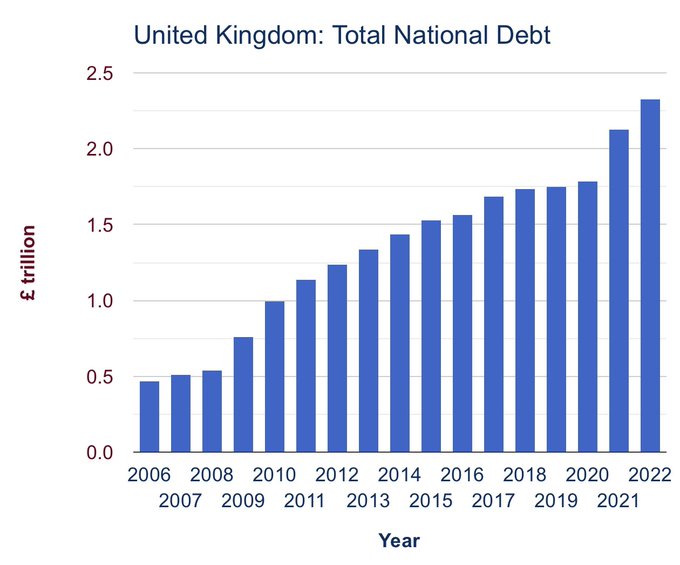

The Washington-based agency, IMF, has forecasted a brief worry for the UK’s Prime Minister Rishi Sunak. The IMF forecasted that the national debts in the United Kingdom to rise over the next five years. This forecast has put the new government at high risk as it contradicts the promises made by the government before coming into power. Rishi Sunak previously pledged to cut the debts as a share of the GDP in the country, but things have turned out differently for him.

The Washington-based organization predicted in its Fiscal Monitor, one of its three annual studies, that the entire UK national debt will continue to rise over the following five years. According to projections, public debt would progressively rise from 103% of the economy’s yearly production, or GDP, in 2022 to 113% by 2028. Along with the rise in GDP, IMF also forecasted a rise in the Net Debt. This Net Debt strips out the financial assets owned by the government. IMFs prediction is that the Net Debt will rise from just under 92% of GDP in 2022 to just over 101% in 2027 and 2028.

“The improvements in the cyclically adjusted primary balance in the euro area and the United Kingdom were smaller at 0.5 and 1.8 percentage points each because further support measures were taken in response to a deterioration of the terms of trade stemming from Russia’s invasion of Ukraine,” the IMF said in one of its statements.

According to the Office for Budget Responsibility, a UK independent forecaster that uses a slightly different technique than the IMF, Sunak was almost on track to get debt on a decreasing trend within five years. The OBR predicted that the national debt would reach its high at just under 95% of GDP in 2026–2027 and then decline by 0.2 percentage points the following year in its budget estimate released last month.

Today we’re rolling out new measures to help with the cost of living and give people peace of mind -Rishi Sunak

The UK’s budget deficit, or the difference between expenditure and tax revenues, peaked at 13% of GDP in 2020, according to the IMF, and would remain at 3.7% of GDP by 2028. Throughout the same time period, it is anticipated that the main budget deficit, which does not include debt interest payments, will decrease from 12% to 1.9% of GDP. Government debts are rising due to the expenditure during the time of COVID to support various individuals, from consumers to businessmen, and have grown more after due to the payments to offset the impact of Russia’s invasion of Ukraine on energy bills. According to the IMF, although there were significant regional variances, the underlying financial condition of advanced nations improved by 3.4 percentage points on average in 2022 when adjusted to account for the economic cycle.

Sources – The Guardian