Introduction:

Checkout.com : A corporation that processes payments is called Checkout Ltd. To help businesses and the communities where they are located prosper in the digital economy, the company provides an online payment platform that focuses on accepting transactions and currencies. International customers can use Checkout.

About:

Checkout.com describes itself as a technological business that deals with money transfers. Through a single integration, it enables businesses to take more payments internationally. Through a single API, its integrated global payment processing platform offers local acquiring, pertinent payment options, feature parity across geographies, fraud filters, and reporting capabilities.

Its payment reporting tool also maintains track of your revenue and customer data. The company’s fraud detection product also monitors in real-time and includes daily risk reports and 3D secure technology. There are both current and potential rivals, including BlueSnap, Square, Stripe, and Braintree.

Website : https://www.checkout.com/

Founder & Team:

Checkout.com, which was established by Guillaume Pousaz in 2010 (an M&A research catalyst) and became a corporation on April 19, 2012, was formerly known as Opus Payments before changing its name to Checkout.com in 2012.

In order to place itself on an upward trajectory, Checkout.com constructed its own platform and backend processing, which it merged with the gateway and licensing. Checkout.com concentrated on developing the technology that drives payments, whilst other technology businesses were focused on expanding their distribution and exposure.

The headquarters of Checkout.com is in London, United Kingdom. The UAE, the US, Mauritius, Singapore, Germany, Hong Kong, and France are among the other countries where it operates.

History:

After turning a profit in 2012, Checkout.com began to grow internationally in 2013, beginning with the UAE. Currently, Checkout.com employs more than 300 people in 8 offices. Revenue increased by 59.64 percent from the prior year to $75 million, according to the 2018 Income Statement, from $47 million (M&A research catalyst). Their gross profit was also impressive in 2018, coming in at $35.5 million, up from $23.9 million the year before (Forbes, 2019). Currently, Deloitte reports a 15,548 percent rise (Deloitte, 2019).

Checkout.com recently secured $230 million in Series A (first round) Investment as of 02/05/2019. (highest ever investment for a Fintech company to date). Insight Venture Management LLC (Insight Partners) and DST Global Advisors Ltd. were the principal investors in this deal. GIC Pte Ltd, Blossom Capital Ltd, and Endeavor Catalyst, a fund managed by Endeavor Global Inc., were also investors in this round. It is uncertain how much money each investor has invested.

Name & Logo:

Checkout.com Highlight:

| Company Name | Checkout.com |

| Founders | Guillaume Pousaz |

| Started at | 2010 |

| Competitors | Amazon Pay.PayPal.Birdeye.FreshBooks.GoCardless.Stripe Payments.Payoneer.Thryv. |

| Website | https://www.checkout.com/ |

| Revenue | $1.14 billion |

| Country | UK |

| Customer care Email | – |

| Customer care Contact details | – |

| Company Valuation | $9.87 billion |

| Industry | Transaction |

| Headquarters | London, United Kingdom |

Revenue:

Adyen announced a 46 percent rise in net revenue to approximately $1.14 billion in 2021, which indicates that it is selling at a multiple of revenue of about 39. A 39x multiple for the company would indicate a valuation of $9.87 billion based on Checkout.com’s 2020 revenues.

Funding & Investors:

There are 13 investors in Checkout.com, including Ribbit Capital and Franklin Templeton Investments.

Business Model:

Checkout.com is a global payment platform that accepts a wide range of payment methods and currencies. Its charge structure varies depending on the type of card, the location of the store, and the bank that issues the customer’s credit card, with fees being passed on directly to the retailer.

Services Offered thru Checkout.com:

For retailers, Checkout.com aims to simplify checkout integration. They give businesses the ability to accept popular credit cards, some digital wallets, as well as some regional payment options and domestic cards, and they are present in a number of places, including Europe.

Awards & Recognition:

There is no data on it.

Competitors:

Top 10 Alternatives to checkout.com

- Amazon Pay.

- PayPal.

- Birdeye.

- FreshBooks.

- GoCardless.

- Stripe Payments.

- Payoneer.

- Thryv.

Latest News:

There is no data on it.

Future Plans:

In comparison to last year’s valuation, that represents a significant gain. The firm secured $450 million in its Series C round at a $15 billion valuation, which is not too shabby considering that it marks a 167 percent valuation increase in just a year.

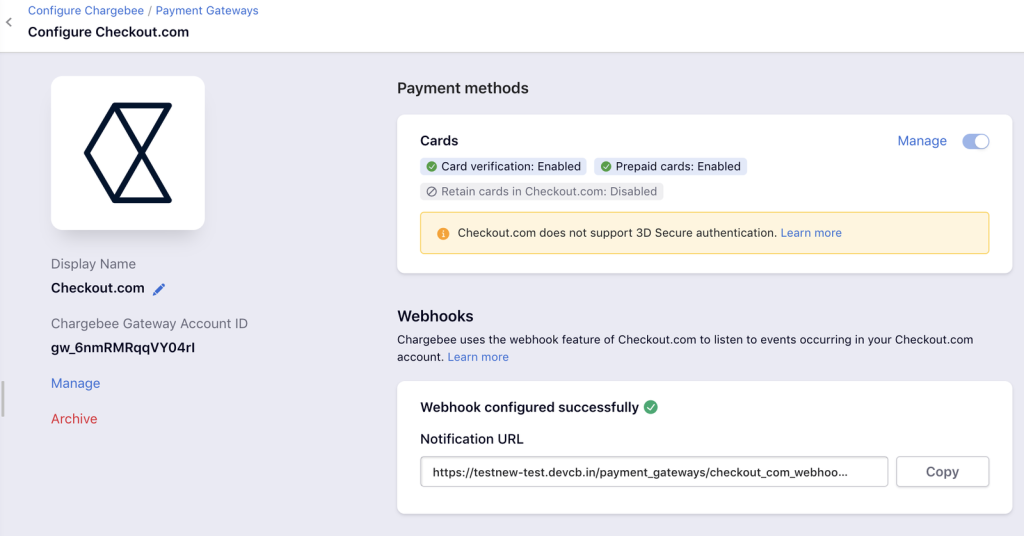

As a gateway, acquirer, risk engine, and payment processor, Checkout.com is creating a full-stack payments organization. You can accept payments through your website or app directly from the company, but you can also use hosted payment pages, construct payment links, etc.

Some FAQs:

Is checkout com a unicorn?

Checkout.com becomes UK’s most valuable tech unicorn.

What is the business model of checkout?

Checkout largely employs a product business model, where it offers a product to retailers to assist in accepting payments from customers. The conventional method of payment for retailers, particularly credit card payments from foreign card issuers, is highly convoluted.

Who are the investors in checkout com?

Altimeter, Dragoneer, Franklin Templeton, GIC, Insight Partners, Qatar Investment Authority, Tiger Global, Oxford Endowment Fund, and another significant west coast mutual fund management company are among the principal investors.

What is the difference between stripe and checkout com?

Differences between Stripe Billing Standard and the Checkout.com standard. In terms of functionality, Checkout.com and Stripe Billing differ in that Stripe Billing is a component of billing and invoicing software while Checkout.com is under the Payment Gateway category.

Conclusion:

One customer segment of Checkout is businesses that want to accept digital credit payments. It is unknown how many people use Checkout.com. They serve the B2B sector, and among their present clients are companies like Deliveroo, Samsung, Virgin, Adidas, and EasyGroup. On the other hand, Checkout has a list of unethical business methods. For instance, they don’t allow the sale of cigarettes and guns at their establishments.

Hi, This is Scoopearth’s admin profile. Scoopearth is a well-known Digital Media Platform. We share Very Authentic and Meaningful information based on Real facts and Verification related to start-ups, technology, Digital Marketing, Business and Finance.

Note: You can reach us at support@scoopearth.com with any further queries.

Linkedin Page : https://www.linkedin.com/company/scoopearth-com/